Loading

Get Canada 1238a 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 1238A online

This guide provides a clear and supportive approach to filling out the Canada 1238A form online. It offers detailed instructions for each section, ensuring users can navigate the process with confidence and accuracy.

Follow the steps to complete the Canada 1238A form effectively.

- Press the ‘Get Form’ button to access the Canada 1238A form and open it in your chosen editor.

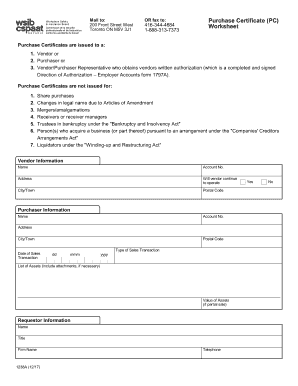

- In the Vendor Information section, fill in the vendor's name, account number, and complete address including city/town and postal code. Indicate whether the vendor will continue to operate by selecting 'Yes' or 'No'.

- In the Purchaser Information section, enter the purchaser's name, account number, and address, ensuring to include the city/town and postal code as well.

- Enter the date of the sales transaction in the format of day (dd), month (mmm), and year (yyyy).

- List the assets involved in the sale, including attachments if necessary, and provide the value of assets only if it is a partial sale.

- In the Requestor Information section, fill in your name, title, firm name, and telephone number.

- Once all fields are complete, you can save changes, download, print, or share the completed form as needed.

Complete your Canada 1238A form online today for a streamlined experience.

To report foreign business income in Canada, you need to include it on your Canadian tax return, fully disclosing the income amount. Ensure compliance with both Canadian tax laws and any international agreements. UsLegalForms offers guidance and tools to assist you in accurately reporting foreign business income aligned with Canada 1238A stipulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.