Loading

Get Canada 3233-87e 2014-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada 3233-87E online

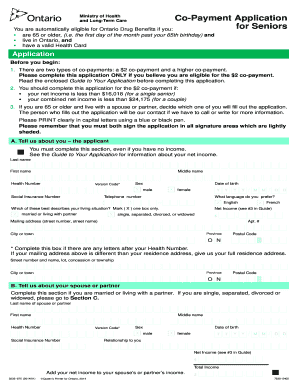

The Canada 3233-87E form is essential for seniors applying for the Ontario Drug Benefit co-payment program. This guide will provide clear instructions on how to complete the form online, ensuring that your application process is smooth and efficient.

Follow the steps to fill out the Canada 3233-87E form effectively.

- Click ‘Get Form’ button to access the Canada 3233-87E document in your preferred online editor.

- Begin with Section A: Tell us about you — the applicant. Enter the required information including your last name, first name, middle name, health number, date of birth, and social insurance number. Be sure to use capital letters and print clearly.

- Indicate your sex by marking the appropriate box. Also, enter your telephone number and choose your preferred language.

- Select your living situation by marking one of the provided options. Enter your net income as specified in the guide.

- Fill in your mailing address. If it's different from your residence address, provide both addresses. Include street number, street name, city, province, and postal code.

- If applicable, move to Section B: Tell us about your spouse or partner. Provide similar information for your spouse or partner, including their last name, first name, health number, and net income.

- In Section C, read and confirm the agreement by signing in the designated areas. Ensure both you and your partner sign where required.

- Gather necessary documents for proof of income as listed in the instructions. Ensure all signatures are complete and that you have included all supporting documents.

- Submit your application by sending all completed forms and documents to the Ontario Drug Benefit Program address provided at the end of the form.

Complete your Canada 3233-87E application online today for timely processing.

Individuals who are not U.S. citizens or residents but earn income from U.S. sources should fill out a W8 form, such as the W-8BEN. This includes foreign individuals and entities, including those in Canada who wish to leverage the benefits of the Canada 3233-87E tax treaty. Completing the form correctly can help reduce withholding tax on U.S. sourced income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.