Loading

Get Canada Quebec Re-503 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Quebec RE-503 online

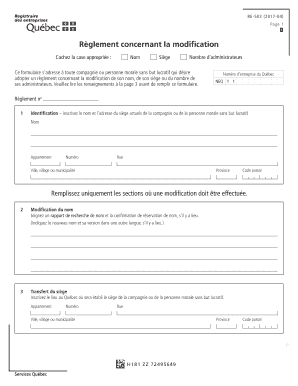

The Canada Quebec RE-503 form is essential for companies or non-profit organizations wishing to modify their name, address, or number of administrators. This guide provides clear, step-by-step instructions for filling out the form online, ensuring a smooth submission process.

Follow the steps to complete the online Canada Quebec RE-503 form.

- Press the ‘Get Form’ button to access the form online and open it in your chosen editor.

- In section 1, enter the current name and address of your company or non-profit organization. Include the apartment number, street name, city, province, and postal code as required.

- If you are modifying the name, complete section 2 by providing the new name and include any name reservation confirmation and search reports as attachments if applicable.

- For changing the address, go to section 3 and input the new address details for the company or non-profit, ensuring you fill out the apartment number, street, city, province, and postal code.

- In section 4, specify the new exact number of administrators for your organization.

- Complete section 5 by signing the form and ensuring that the resolution has been adopted by the required majority at an extraordinary meeting. Indicate the date and check the appropriate box regarding the vote.

- After filling out all necessary sections, review your inputs for accuracy. Then, save your changes, and you can choose to download, print, or share the completed form as needed.

Complete your Canada Quebec RE-503 form online today for a streamlined process.

Related links form

Yes, if you are operating a business in Quebec under a name that is not your own, you need to register your business name with the appropriate provincial authority. This ensures compliance with local regulations and protects your business interests. Canada Quebec RE-503 can assist you in understanding the registration process and necessary documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.