Loading

Get Uk Iht423 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK IHT423 online

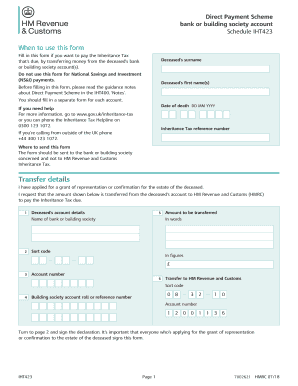

The UK IHT423 form is essential for users who wish to pay the Inheritance Tax due by transferring funds from the deceased’s bank or building society account. This guide will provide clear instructions on how to complete the form online efficiently and accurately.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to access the IHT423 form and open it in your preferred online platform.

- Enter the deceased’s surname and first name(s) as they appear on official documents. Ensure accuracy to avoid processing delays.

- Provide the date of death in the format DD MM YYYY. This information is crucial for tax processing and should be verified for correctness.

- Fill in the Inheritance Tax reference number. This is the unique identifier assigned to the estate, and it is essential for tracking purposes.

- Complete the deceased’s bank or building society account details, including the name of the institution, sort code, and account number. Be precise with these details.

- Indicate the amount to be transferred by writing it in figures and also in words to ensure there are no discrepancies.

- Sign the declaration on page 2 of the form. It is mandatory for all applicants seeking grant of representation or confirmation to sign the form.

- Submit the completed form directly to the concerned bank or building society and not to HM Revenue and Customs.

Complete your online forms today to ensure a smooth processing of Inheritance Tax payments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can gift £100,000 to your son in the UK, but you must consider the Inheritance Tax implications. Gifts above the annual exemption limit may affect your estate’s tax liability after death. To understand how your gifts impact the UK IHT423, it is beneficial to seek qualified advice.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.