Get Wi Publication Rr-071 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign WI Publication RR-071 online

How to fill out and sign WI Publication RR-071 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Choosing a legal specialist, creating a scheduled visit and coming to the business office for a private meeting makes finishing a WI Publication RR-071 from start to finish exhausting. US Legal Forms allows you to rapidly produce legally-compliant documents based on pre-constructed online blanks.

Prepare your docs within a few minutes using our straightforward step-by-step guide:

- Find the WI Publication RR-071 you need.

- Open it up using the cloud-based editor and begin altering.

- Fill out the blank areas; engaged parties names, places of residence and phone numbers etc.

- Customize the blanks with unique fillable areas.

- Put the day/time and place your electronic signature.

- Simply click Done following double-examining all the data.

- Download the ready-produced document to your system or print it out like a hard copy.

Swiftly generate a WI Publication RR-071 without having to involve experts. There are already more than 3 million customers taking advantage of our rich collection of legal documents. Join us today and get access to the top collection of online blanks. Test it yourself!

How to edit WI Publication RR-071: customize forms online

Have your stressless and paper-free way of modifying WI Publication RR-071. Use our trusted online option and save a great deal of time.

Drafting every document, including WI Publication RR-071, from scratch requires too much time, so having a tried-and-tested solution of pre-drafted document templates can do magic for your productivity.

But modifying them can be challenge, especially when it comes to the files in PDF format. Luckily, our extensive catalog has a built-in editor that lets you easily complete and edit WI Publication RR-071 without leaving our website so that you don't need to waste time completing your paperwork. Here's what you can do with your file utilizing our tools:

- Step 1. Locate the required document on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Take advantage of specialized editing features that allow you to insert, remove, annotate and highlight or blackout text.

- Step 4. Create and add a legally-binding signature to your file by using the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you want it, utilize the features on the right to remove, add, and re-order pages.

- step 6. Insert fillable fields so other parties can be invited to complete the document (if applicable).

- Step 7. Pass around or send the document, print it out, or select the format in which you’d like to get the document.

Whether you need to execute editable WI Publication RR-071 or any other document available in our catalog, you’re well on your way with our online document editor. It's easy and secure and doesn’t require you to have particular skills. Our web-based tool is set up to deal with practical everything you can imagine concerning document editing and execution.

Forget about the traditional way of handling your forms. Go with a a professional solution to help you streamline your tasks and make them less dependent on paper.

Related links form

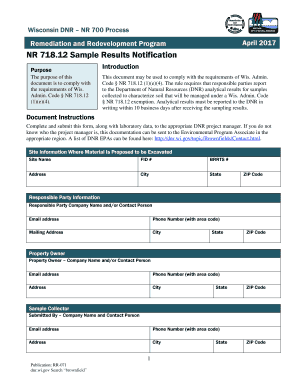

Landfills that were established before 1970 and were never licensed by the Wisconsin Department of Natural Resources (DNR) are called historic fill sites. The DNR's administrative codes prohibit the placement of structures or other development on buried waste without an exemption to Wis. Admin.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.