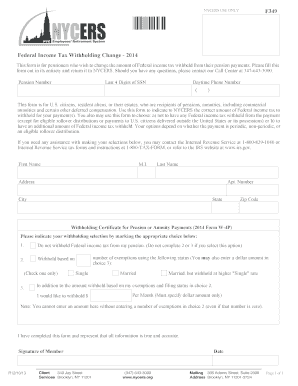

Get Ny Nycers F349 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY NYCERS F349 online

How to fill out and sign NY NYCERS F349 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The days of terrifying complicated tax and legal documents are over. With US Legal Forms the procedure of filling out official documents is anxiety-free. The leading editor is already close at hand giving you various useful tools for submitting a NY NYCERS F349. The following tips, combined with the editor will help you through the complete process.

- Select the orange Get Form button to start editing and enhancing.

- Switch on the Wizard mode on the top toolbar to obtain more pieces of advice.

- Complete every fillable field.

- Make sure the data you add to the NY NYCERS F349 is updated and correct.

- Add the date to the form using the Date function.

- Select the Sign icon and make a digital signature. Feel free to use 3 options; typing, drawing, or capturing one.

- Make certain every area has been filled in properly.

- Click Done in the top right corne to save or send the form. There are various options for receiving the doc. An attachment in an email or through the mail as a hard copy, as an instant download.

We make completing any NY NYCERS F349 more convenient. Get started now!

How to edit NY NYCERS F349: customize forms online

Find the right NY NYCERS F349 template and edit it on the spot. Simplify your paperwork with a smart document editing solution for online forms.

Your daily workflow with documents and forms can be more effective when you have all you need in one place. For instance, you can find, obtain, and edit NY NYCERS F349 in one browser tab. If you need a particular NY NYCERS F349, you can easily find it with the help of the smart search engine and access it instantly. You do not need to download it or look for a third-party editor to edit it and add your details. All of the resources for effective work go in one packaged solution.

This modifying solution enables you to modify, fill, and sign your NY NYCERS F349 form right on the spot. Once you find a suitable template, click on it to go to the modifying mode. Once you open the form in the editor, you have all the necessary tools at your fingertips. You can easily fill in the dedicated fields and erase them if needed with the help of a simple yet multifunctional toolbar. Apply all the modifications instantly, and sign the form without exiting the tab by merely clicking the signature field. After that, you can send or print your document if needed.

Make more custom edits with available tools.

- Annotate your document using the Sticky note tool by placing a note at any spot within the document.

- Add necessary graphic components, if needed, with the Circle, Check, or Cross tools.

- Modify or add text anywhere in the document using Texts and Text box tools. Add content with the Initials or Date tool.

- Modify the template text using the Highlight and Blackout, or Erase tools.

- Add custom graphic components using the Arrow and Line, or Draw tools.

Discover new possibilities in efficient and easy paperwork. Find the NY NYCERS F349 you need in minutes and fill it in in the same tab. Clear the mess in your paperwork once and for all with the help of online forms.

401(k), 403(b), and other qualified workplace retirement plans: Plan providers typically withhold 20% on taxable distributions—unless the withdrawal is made to satisfy the annual required minimum distributions (RMDs) mandated by the IRS, which conform to IRA withholding rules.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.