Get Il Nfp 111.25 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL NFP 111.25 online

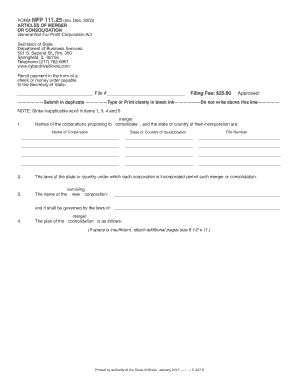

The IL NFP 111.25 form is an essential document for organizations seeking to merge or consolidate under the General Not For Profit Corporation Act. This guide will assist you in completing the form efficiently and accurately, ensuring compliance with state requirements.

Follow the steps to fill out the IL NFP 111.25 form online effectively.

- Click the ‘Get Form’ button to obtain the IL NFP 111.25 document and open it in the digital editor.

- In the first section, provide the names of the corporations involved in the merger or consolidation along with their corresponding file numbers. Make sure to type clearly.

- Indicate the state or country of incorporation for each corporation in the designated fields.

- In the next section, specify the name of the surviving or new corporation that will result from the merger or consolidation.

- Outline the plan for the consolidation in the designated space. If additional space is needed, attach separate pages.

- For each corporation, indicate how the plan of consolidation was approved. Use the options provided (i.e., vote by directors or members) and insert the appropriate letters in the box next to each corporation name.

- If the surviving or new corporation is not an Illinois corporation, agree to be served with process in the state for obligations resulting from the merger.

- Ensure all sections are completed in black ink. The authorized officers must sign and date the document in the provided areas.

- Finally, review the completed form for accuracy. You can save changes, download the document, print it, or share it as needed.

Start filling out the IL NFP 111.25 form online today to complete your merger or consolidation process.

To register an NFP in Illinois, follow the guidelines set forth in IL NFP 111.25. Start by preparing your Articles of Incorporation, ensuring they meet state requirements. Then, file these documents with the Illinois Secretary of State. If you want to streamline the process, uslegalforms provides helpful resources and templates that guide you through registration efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.