Loading

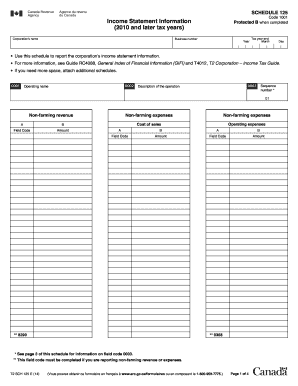

Get Canada T2 Sch 125 E 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2 SCH 125 E online

Filling out the Canada T2 SCH 125 E form online is an essential part of reporting your corporation's income statement information for tax purposes. This guide provides clear and systematic steps to help you complete the form accurately and efficiently.

Follow the steps to successfully fill out the Canada T2 SCH 125 E form.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter the corporation's name and business number in the designated fields. Ensure that you input the correct year and tax year-end date (month and day).

- For the operating name, provide the name under which the corporation operates, if different from the corporation's name. Describe the operation in the designated space.

- Proceed to report non-farming revenue and expenses. Enter the amount for non-farming revenue and respective operating expenses in the appropriate fields, including cost of sales. Remember to use the designated field codes.

- Continue to farming revenue and expenses if applicable. Fill in the revenue and expenses related to farming activities using the appropriate field codes provided in the guide.

- If you have extraordinary items or income taxes to report, complete those sections accordingly.

- Review your entries for accuracy and completeness. If you need more space, you can attach additional schedules as necessary.

- Once you have filled out all relevant sections, you can save changes, download, print, or share the completed form.

Complete your Canada T2 SCH 125 E form online today for a smooth tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To secure a single status declaration in Canada, you'll typically need to submit a request to your provincial registrar or local courthouse. It's important to bring identification and any documents that may bolster your application. This declaration can streamline the tax filing process, especially when completing forms like the Canada T2 SCH 125 E.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.