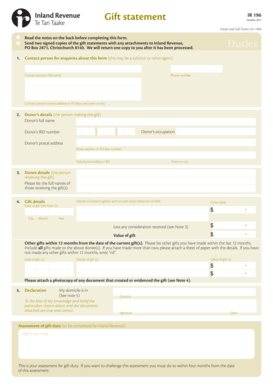

Get Nz Ir 196 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NZ IR 196 online

How to fill out and sign NZ IR 196 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The preparation of legal documents can be expensive and time-ingesting. However, with our pre-built web templates, everything gets simpler. Now, creating a NZ IR 196 requires not more than 5 minutes. Our state web-based blanks and clear guidelines remove human-prone errors.

Follow our easy steps to get your NZ IR 196 prepared quickly:

- Pick the template in the catalogue.

- Complete all required information in the required fillable fields. The intuitive drag&drop user interface makes it easy to add or relocate areas.

- Ensure everything is filled out correctly, without typos or missing blocks.

- Use your e-signature to the page.

- Click Done to confirm the changes.

- Save the papers or print out your copy.

- Submit instantly towards the recipient.

Make use of the quick search and powerful cloud editor to make a precise NZ IR 196. Remove the routine and make documents on the web!

How to edit NZ IR 196: customize forms online

Make the most of our powerful online document editor while completing your paperwork. Fill out the NZ IR 196, emphasize on the most important details, and easily make any other necessary alterations to its content.

Preparing documentation electronically is not only time-saving but also comes with a possibility to alter the sample in accordance with your needs. If you’re about to work on NZ IR 196, consider completing it with our extensive online editing tools. Whether you make an error or enter the requested data into the wrong field, you can instantly make changes to the form without the need to restart it from the beginning as during manual fill-out. Aside from that, you can point out the critical information in your document by highlighting specific pieces of content with colors, underlining them, or circling them.

Adhere to these simple and quick steps to complete and edit your NZ IR 196 online:

- Open the form in the editor.

- Type in the necessary information in the blank areas using Text, Check, and Cross tools.

- Adhere to the document navigation to avoid missing any essential areas in the sample.

- Circle some of the critical details and add a URL to it if necessary.

- Use the Highlight or Line options to stress on the most important facts.

- Decide on colors and thickness for these lines to make your sample look professional.

- Erase or blackout the data you don’t want to be visible to others.

- Replace pieces of content that contain mistakes and type in text that you need.

- End up modifcations with the Done button once you make certain everything is correct in the document.

Our robust online solutions are the most effective way to complete and modify NZ IR 196 in accordance with your demands. Use it to prepare personal or professional documentation from anyplace. Open it in a browser, make any adjustments to your documents, and get back to them at any moment in the future - they all will be safely stored in the cloud.

The federal gift tax applies whenever you give someone besides your spouse a gift worth more than $16,000 in 2022 or $17,000 in 2023....Gift tax rates. Value of gift in excess of the annual exclusionTax rate$80,001 to $100,00028%$100,001 to $150,00030%$150,001 to $250,00032%$250,001 to $500,00034%8 more rows • Jan 13, 2023

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.