Loading

Get Form 25 A Funeral Expenses Claim

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

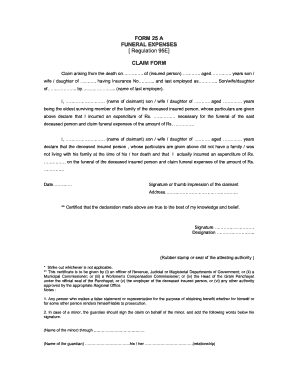

How to fill out the Form 25 A Funeral Expenses Claim online

This guide will assist you in completing the Form 25 A Funeral Expenses Claim online in a clear and efficient manner. By following the outlined steps, you will be able to provide the necessary information required to submit your claim smoothly.

Follow the steps to successfully submit your claim online.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin filling out the form by entering the date of death of the insured person in the specified field.

- Provide the name of the insured person and their age at the time of death in the designated areas.

- Indicate your relationship to the insured person by selecting the appropriate descriptor (for example, son, daughter, or partner).

- In the next section, provide the insurance number of the deceased individual.

- Fill in the details of the last employer of the insured person as required.

- Complete the claimant’s information by entering your name and age, along with your status as the eldest surviving member of the family.

- Declare the funeral expenses incurred by entering the total amount spent on the funeral in the designated field.

- If applicable, indicate whether the deceased insured person was living with their family at the time of death and fill in the corresponding fields regarding the expenses incurred.

- Date the form appropriately and provide your signature or thumb impression.

- Enter your address in the specified section.

- Ensure the certification section is completed by obtaining the required signatures and seals from the relevant authority.

- Review the completed form for accuracy and completeness before saving your changes, downloading, printing, or sharing the document as necessary.

Start filling out your Form 25 A Funeral Expenses Claim online today.

You can claim funeral expenses by listing them on the estate's tax return, typically through Form 706. Moreover, if these expenses are eligible for direct deductions, you can document them via the Form 25 A Funeral Expenses Claim. Make sure to attach any supporting documentation that verifies the funeral expenses. Taking these steps will help you ensure a comprehensive claim.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.