Loading

Get Canada Fidelity Nr301 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Fidelity NR301 online

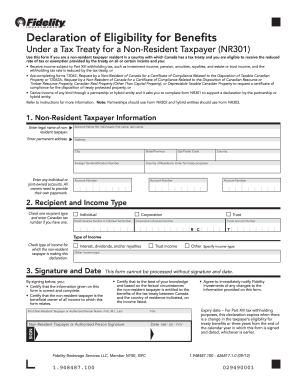

Filling out the Canada Fidelity NR301 form is essential for non-resident taxpayers seeking benefits under the Canada tax treaty. This guide provides clear, step-by-step instructions to help you navigate the form correctly and efficiently.

Follow the steps to complete the Canada Fidelity NR301 form online.

- Click ‘Get Form’ button to access the NR301 form and open it in your chosen online editor.

- In the first section, 'Non-Resident Taxpayer Information', enter the legal name of the non-resident taxpayer, permanent address, and the foreign tax identification number if applicable. Make sure to specify the account number and choose the appropriate country of residence.

- Proceed to the 'Recipient and Income Type' section. Check the appropriate recipient type (individual, corporation, or trust) and enter your Canadian tax number if you have one. Then, select the type of income for which you are making this declaration, such as interest, dividends, or other specified income.

- In the final section titled 'Signature and Date', ensure the form is signed and dated. This is essential for processing. Confirm that all provided information is correct and complete, and specify the name of the person signing the form.

- After completing all fields, review the form for accuracy. Finally, save changes, download, print, or share the form as needed.

Complete your Canada Fidelity NR301 form online today to ensure you receive the tax benefits you are entitled to.

Filling out the W-8BEN form as a Canadian involves providing your name, address, and TIN, along with declaration of your residency status. Make sure to refer to the specific articles of the Canada-US tax treaty to maximize benefits. If you need assistance, the USLegalForms platform can provide tools and resources to help you throughout the process related to Canada Fidelity NR301.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.