Loading

Get Canada Lm-1.a - Quebec 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada LM-1.A - Quebec online

This guide will help you navigate and fill out the Canada LM-1.A - Quebec form online with ease. Whether you are requesting the cancellation or modification of your business registration, this step-by-step instruction is designed to assist you in completing the form accurately.

Follow the steps to complete your Canada LM-1.A - Quebec form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

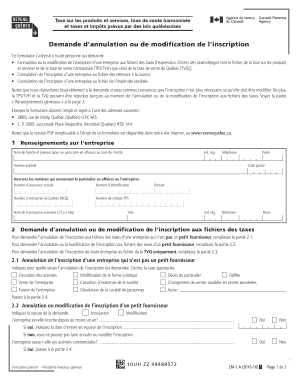

- Proceed to the section labeled 'Renseignements sur l’entreprise' where you will input the necessary business details. Include the name of the individual or entity, registration number, phone number, and postal address. Additionally, provide their social insurance number and Quebec enterprise number (NEQ), if applicable.

- In the section 'Demande d’annulation ou de modification de l’inscription aux fichiers des taxes,' indicate whether you are requesting cancellation or modification. Depending on whether the business is a small supplier or not, check the relevant box and complete the applicable subsection (2.1 for businesses not classified as small suppliers, 2.2 for small suppliers, or 2.3 for cancellation only to the TVQ file).

- If you selected the cancellation for a non-small supplier (Part 2.1), indicate the reason for this request by checking the appropriate box, such as cessation of activities, bankruptcy, or company sale. Then, proceed to Part 2.4.

- For small suppliers (Part 2.2), specify whether you are requesting cancellation or modification. Verify if your business has been registered for at least one year. If so, proceed to state the total taxable sales made in the past four quarters.

- In Part 2.3, if you opt for the cancellation of the TVQ registration only, list the provinces where your business continues to operate.

- Indicate the effective date for the cancellation or modification in Part 2.4. This will determine when your business will cease to collect taxes on taxable sales.

- In Part 2.5, include the fair market value of any assets held at the time of the cancellation or modification.

- Complete any additional sections for the source deductions or corporate taxes as applicable. Include reasons and effective dates if they differ from previous sections.

- Finally, sign the form, ensuring that the signed individual is authorized to represent the business. Include the date and title of the signer.

- After filling out the form, save any changes, download a copy for your records, and be prepared to print or share the completed document if necessary.

Complete your Canada LM-1.A - Quebec form online today to ensure your business remains compliant.

Calculating your income tax return in Quebec involves gathering all income documents and applicable deductions. You will need to complete the TP-1.D form, or utilize tax software that supports Quebec calculations. For a smoother experience with tax returns under Canada LM-1.A - Quebec, consider using trusted platforms like USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.