Get Canada T1213 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1213 online

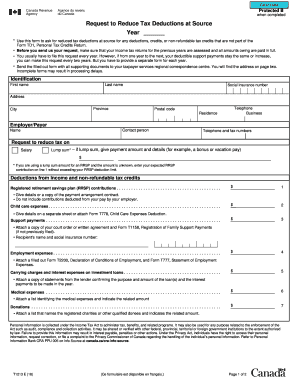

The Canada T1213 form is essential for users seeking to reduce tax deductions at source. This guide provides clear and comprehensive steps to fill out the form online, ensuring you have the information needed for a successful submission.

Follow the steps to accurately complete your Canada T1213 form online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- In the identification section, provide your first name, last name, social insurance number, address, province, city, and postal code. Also, include your contact telephone number.

- Fill in the employer or payer information, including the contact person’s name and their telephone and fax numbers.

- Indicate the request to reduce tax on salary or lump sum payments. If you are reporting a lump sum, include the payment amount and any relevant details.

- List deductions from income and non-refundable tax credits, such as registered retirement savings plan contributions. Ensure to include only contributions not deducted from your pay.

- For child care expenses, provide details on a separate sheet or attach Form T778.

- If applicable, detail support payments with supporting documents attached.

- Outline employment expenses and attach filled out Forms T2200 and T777, if necessary.

- Document any carrying charges and interest expenses on investment loans, attaching confirmation statements as required.

- List medical expenses, enclosing a detailed list of the related amounts.

- Include donations made, attaching relevant lists of registered charities or other qualified donees.

- Summarize all amounts to be deducted from income and calculate the net amount requested for tax waiver.

- Certify the information on the form is correct by signing and dating the document.

- Submit the completed form along with all supporting documents to the appropriate taxpayer services regional correspondence centre. Ensure that you check for the correct mailing address before submission.

Complete your Canada T1213 form online today to effectively manage your tax deductions.

Get form

Filing a zero corporate tax return in Canada involves completing the corporate income tax form (T2) and indicating that your corporation has no income or tax liabilities for the year. You still need to provide basic information about your company and file by the deadline. Using tools like US Legal Forms can simplify this process, ensuring that you meet all requirements while properly submitting your Canada T1213 if applicable.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.