Loading

Get Vat 426

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 426 online

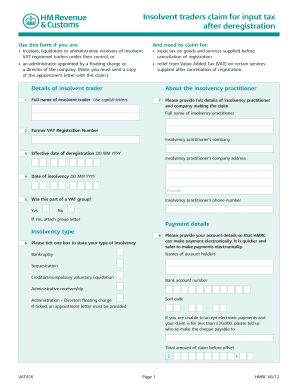

The Vat 426 form is essential for claiming input tax relief for insolvent traders. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that users can navigate the process with confidence.

Follow the steps to successfully complete the Vat 426 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Provide details of the insolvent trader. Enter the full name of the insolvent trader using capital letters. Ensure accuracy as this information is critical for the claim.

- Input the former VAT registration number associated with the insolvent trader. This identifies the trader's previous VAT status.

- Fill in the effective date of deregistration in the format DD MM YYYY. This marks when the trader's VAT registration ceased.

- Enter the date of insolvency using the same format. This date is important to establish the context of the claim.

- Indicate whether the insolvent trader was part of a VAT group by selecting 'Yes' or 'No'. If 'Yes', attach the group letter.

- Choose the type of insolvency from the provided options by ticking the appropriate box, such as bankruptcy or administration.

- Insert your account details to facilitate electronic payments. Include the names of account holders, bank account number, and sort code for faster processing.

- Calculate the total amount of claim before offset and enter it into the designated field. This is the total VAT you are claiming.

- In the space provided, share any additional information pertinent to processing your claim, ensuring clarity and completeness.

- Carefully complete and sign the declaration at the bottom of the form, confirming the authenticity and accuracy of your claim.

- Submit the completed form along with any necessary attachments to the National Insolvency Unit, ensuring you retain copies for your records.

Start filling out the Vat 426 form online to ensure you claim the input tax relief you are entitled to.

The three main types of VAT include standard rate VAT, zero rate VAT, and exempt VAT. Standard rate VAT applies to most goods and services, while zero rate VAT is used for specific items often seen as essential. Exempt VAT indicates items that do not incur VAT and facilitates understanding of different tax obligations. Knowing these types can aid in better financial planning and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.