Loading

Get Jvat 400 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Jvat 400 online

Completing the Jvat 400 form correctly is essential for ensuring compliance with tax regulations. This guide provides clear instructions to help you navigate each section of the form with confidence.

Follow the steps to fill out the Jvat 400 form seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

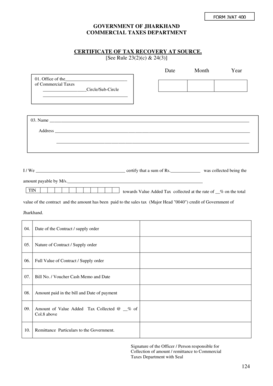

- In the first section, fill in the 'Office of the' line with the relevant office name of the Commercial Taxes Department, including the specific Circle or Sub-Circle.

- Enter the date, month, and year in the designated fields to indicate when the form is being filled out.

- Provide your name and address in the respective fields, ensuring all information is accurate and complete.

- In the certification statement, indicate the total amount collected and the name of the business entity responsible for the payment. Ensure the Tax Identification Number (TIN) is also included.

- Specify the rate of Value Added Tax (VAT) applied, based on the total value of the contract.

- Fill in the date of the contract or supply order in the allocated space.

- Describe the nature of the contract or supply order to provide clarity about the transaction.

- Record the full value of the contract or supply order, followed by the bill number or voucher cash memo along with its date.

- Indicate the amount paid in the bill and the corresponding date of payment to showcase transaction details.

- Calculate and enter the amount of Value Added Tax collected at the specified percentage based on the amount recorded in the previous step.

- Finally, complete the remittance particulars to the government, ensuring all amounts align accurately.

- Add your signature as the officer or person responsible for collecting the amount or remitting to the Commercial Taxes Department, and include your seal.

- Once all sections are filled out, you can choose to save changes, download, print, or share the form as needed.

Start completing your Jvat 400 form online today!

To file form 4684, begin with collecting all relevant documentation related to your loss. The Jvat 400 process through uslegalforms simplifies finding the right guidance for completing this form. Ensure that you provide accurate descriptions and values for your losses to comply with IRS requirements. Once completed, file your form with your tax return or separately, depending on your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.