Loading

Get Fannie Mae Occupancy Affidavit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae Occupancy Affidavit online

Filling out the Fannie Mae Occupancy Affidavit is a crucial step in certifying your intent to occupy a property as your primary residence. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to complete your affidavit online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

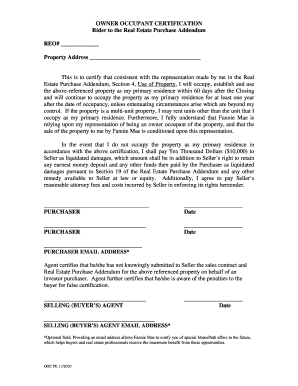

- Begin by entering the REO number in the designated field to ensure your affidavit is associated with the correct property.

- Provide the property address in the specified area. Ensure all details are accurate to avoid any legal issues.

- Read the certification statement carefully. Acknowledge your commitment to occupy the property as your primary residence within 60 days after closing.

- Confirm your understanding of the terms related to occupancy and the conditions that apply if you fail to occupy the property.

- Sign the affidavit by providing your name, indicating your role as the purchaser, along with the date.

- If there are multiple purchasers, ensure that each person signs and dates the affidavit in the corresponding sections.

- Enter your email address in the optional field to receive notifications about special HomePath offers.

- Certify the affidavit by having the selling agent fill out their details and sign, including the date and email address if applicable.

- Once all sections are completed, review your entries for accuracy and clarity. Save your changes, and if needed, download or print the affidavit for your records.

Complete your Fannie Mae Occupancy Affidavit online now to ensure a smooth transaction!

A Home Equity Line of Credit (HELOC) uses a deed of trust or a mortgage as its security instrument. This allows lenders to secure their interests in the property while providing flexible access to funds for the borrower. It is vital to consider how the Fannie Mae Occupancy Affidavit fits into this framework when applying for a HELOC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.