Loading

Get Dtf 801 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dtf 801 online

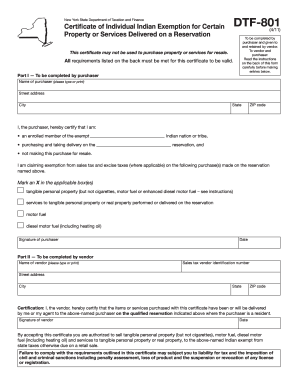

The Dtf 801 form is essential for individuals seeking a tax exemption for certain purchases made on qualified reservations in New York State. This comprehensive guide will assist you in accurately completing the form online, ensuring that you meet all necessary requirements.

Follow the steps to complete the Dtf 801 form online

- Click the ‘Get Form’ button to access the Dtf 801 form and open it in your preferred editor.

- In Part I, enter the purchaser's name in the designated field, ensuring it is printed clearly or typed for legibility. Next, provide the street address, city, state, and ZIP code.

- Certify your eligibility by selecting the appropriate checkboxes. You must confirm that you are an enrolled member of the relevant Indian nation or tribe and that the purchase is for personal use, not for resale.

- In this part, indicate the nature of your purchase by marking an 'X' in the applicable box or boxes, whether it be tangible personal property, motor fuel, or services.

- Sign and date the form as the purchaser, confirming that all provided information is accurate.

- In Part II, the vendor must complete their section by filling in their name, sales tax vendor identification number, address, and other required details.

- The vendor should verify their delivery of the items or services to the purchaser at the specified location and sign and date the certification.

- Finally, review all completed sections for accuracy. Save any changes you made to the form, download it if necessary, and consider printing or sharing it as needed.

Complete your Dtf 801 form online today to ensure you receive the tax exemptions you are entitled to.

To be tax-exempt means that you qualify for a status that frees you from paying certain taxes. This could result from various factors, including your income sources or participation in non-profit activities. Exploring the tax-exempt process, particularly with forms like Dtf 801, can be streamlined with tools from uslegalforms, ensuring you stay informed and compliant.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.