Get Id D-cr (misc7) 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

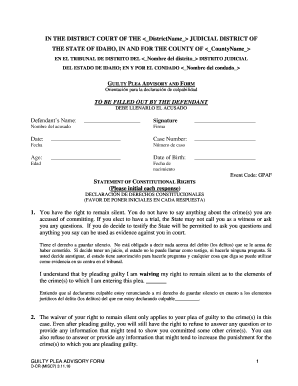

Tips on how to fill out, edit and sign DECLARA online

How to fill out and sign TIENE online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

US Legal Forms focuses to assist you through the process of ID D-CR (MISC7) preparing and simultaneously makes it faster and more handy. The platform will reduce your effort and time in preparing legal paperwork while guaranteeing security.

Learn these easy methods to complete ID D-CR (MISC7):

-

Use the Search Engine to get the template.

-

Open the template with the help of the full-fledged web-based editor.

-

Read through the tips and instructions in the template in order to avoid faults while completing necessary information.

-

For your convenience, the fillable fields are marked in yellow. Click on them and provide the necessary information.

-

After you have finished all of the fillable fields, date and sign the blank.

-

Double-check the template for mistakes and faults and employ the unique upper menu toolbar to edit the words

-

When you have completed completing the sample, simply click Done.

-

Save the template to your device for further submission.

-

E-submit or print your legal record.

Never has ID D-CR (MISC7) e-filing been so simple and fast than with US Leagal Forms

How to edit Delitos: customize forms online

Your easily editable and customizable Delitos template is within easy reach. Take advantage of our library with a built-in online editor.

Do you postpone preparing Delitos because you simply don't know where to begin and how to move forward? We understand your feelings and have a great solution for you that has nothing nothing to do with fighting your procrastination!

Our online catalog of ready-to-edit templates lets you search through and pick from thousands of fillable forms adapted for a number of use cases and scenarios. But getting the form is just scratching the surface. We offer you all the necessary features to fill out, sign, and edit the template of your choosing without leaving our website.

All you need to do is to open the template in the editor. Check the verbiage of Delitos and confirm whether it's what you’re looking for. Start off modifying the form by using the annotation features to give your form a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and fix the existing text.

- If the template is meant for other people too, you can add fillable fields and share them for other parties to fill out.

- Once you’re done modifying the template, you can get the file in any available format or choose any sharing or delivery options.

Summing up, along with Delitos, you'll get:

- A powerful set of editing} and annotation features.

- A built-in legally-binding eSignature functionality.

- The ability to create documents from scratch or based on the pre-uploaded template.

- Compatibility with various platforms and devices for increased convenience.

- Numerous options for protecting your files.

- A wide range of delivery options for easier sharing and sending out files.

- Compliance with eSignature laws regulating the use of eSignature in electronic operations.

With our full-featured solution, your completed documents are always lawfully binding and totally encoded. We make certain to guard your most vulnerable information and facts.

Get what is needed to produce a professional-hunting Delitos. Make the best choice and attempt our foundation now!

Related links form

Yes, you can often find your 1099-MISC information online, especially if your payer provides digital access to tax documents. Many companies use online portals where you can log in to retrieve your forms securely. If your payer doesn’t offer this option, you can request a copy directly from them or utilize services like USLegalForms to help you gather the necessary documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.