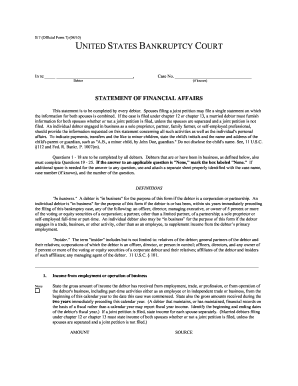

Get Bankruptcy 7 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Bankruptcy 7 online

How to fill out and sign Bankruptcy 7 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Although submitting legal documents is generally a stressful and time-consuming task, it offers a chance to complete them effortlessly by utilizing the US Legal Forms service.

It supplies you with the Bankruptcy 7 and guides you through the entire procedure, allowing you to feel confident about accurately completing the form.

Complete the Bankruptcy 7 on US Legal Forms even while on the move and from any device.

- Initiate the form using a feature-rich online editor to start filling it out.

- Follow the green arrow on the left side of the webpage. It will indicate the fields you should complete with the label Fill.

- As you enter the required details, the label on the green arrow may change to Next. When you click it, it will take you to the subsequent fillable field, ensuring that you do not overlook any sections.

- Sign the document using the e-signing tool. Create, type, or scan your signature, whichever method you prefer.

- Select Date to enter the current date on the Bankruptcy 7. This will likely be done automatically.

- Optionally review the tips and suggestions to confirm that you haven’t overlooked anything and examine the document.

- Once you have completed the document, select Done.

- Download the file to your device.

How to modify Get Bankruptcy 7 2010: customize forms online

Filling out documents is straightforward with intelligent online tools. Eliminate paperwork with easily accessible Get Bankruptcy 7 2010 templates you can adjust online and print.

Creating documents should be more convenient, whether it’s a regular part of one’s job or an infrequent task. When someone needs to submit a Get Bankruptcy 7 2010, learning the rules and guides on how to fill out a form accurately and what it must comprise can consume considerable time and effort. Nonetheless, if you discover the appropriate Get Bankruptcy 7 2010 template, completing a document will no longer be a hurdle with an intelligent editor available.

Explore a wider array of features you can incorporate into your document workflow. There’s no requirement to print, fill in, and annotate forms by hand. With a smart editing platform, all the vital document processing features are perpetually available. If you desire to optimize your working experience with Get Bankruptcy 7 2010 forms, locate the template in the directory, click on it, and discover an easier method to complete it.

If the form requires your initials or date, the editor includes tools for that too. Minimize the risk of mistakes by using the Initials and Date tools. It is also simple to append custom graphic elements to the form. Utilize the Arrow, Line, and Draw tools to modify the document. The more features you are acquainted with, the simpler it is to manage Get Bankruptcy 7 2010. Experience the solution that provides all the necessary elements to find and alter forms in one browser tab and leave behind manual paperwork.

- If you wish to insert text in a random section of the form or add a text field, employ the Text and Text field tools and expand the text in the form as needed.

- Use the Highlight tool to emphasize the crucial sections of the form.

- If you want to hide or eliminate certain text parts, use the Blackout or Erase tools.

- Personalize the form by integrating default graphic elements into it.

- Utilize the Circle, Check, and Cross tools to add these features to the forms, if feasible.

- If you require further annotations, leverage the Sticky note tool and place as many notes on the forms page as necessary.

Declaring Bankruptcy 7 starts with gathering your financial documents and assessing your debts. Next, you need to complete the necessary bankruptcy forms and file them with the court. Financial counseling is a mandatory step before filing, ensuring you understand the implications. US Legal Forms provides comprehensive resources and guidance to help streamline this process, making it easier for you to achieve a fresh financial start.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.