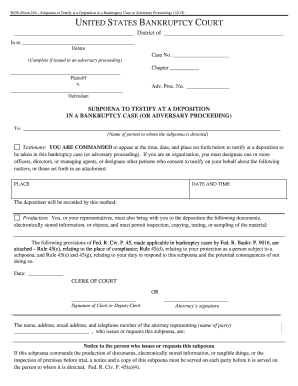

Get Bankruptcy B256 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Bankruptcy B256 online

How to fill out and sign Bankruptcy B256 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Though submitting legal documents is typically a stressful and lengthy undertaking, the US Legal Forms service offers a chance to complete them easily.

It provides you with the Bankruptcy B256 and guides you through the entire procedure, enabling you to feel assured in timely and accurate completion.

Complete Bankruptcy B256 on US Legal Forms, even while on the move and from any device.

- Access the document using the comprehensive online editor to begin filling it out.

- Follow the green arrow located on the left side of the webpage. It will indicate which fields you need to fill in with the word Fill.

- As you input the required information, the label on the green arrow will switch to Next. Clicking it will take you to another fillable section, ensuring you don’t overlook any fields.

- Affix your signature to the document using the e-signature tool. You can draw, type, or upload your signature based on your preference.

- Click on Date to input the current date on the Bankruptcy B256; this will likely be done automatically.

- Optionally review the hints and suggestions to confirm you haven't overlooked anything significant and verify the formatting.

- Once you have finished filling out the template, click Done.

- Download the document to your device.

How to Alter Get Bankruptcy B256 2013: Personalize Forms Online

Explore a unique service to handle all your documentation with ease.

Locate, adjust, and finalize your Get Bankruptcy B256 2013 within a single platform using intelligent tools.

The days of having to print forms or write them by hand are behind us. Nowadays, all it requires to obtain and complete any form, such as Get Bankruptcy B256 2013, is to open just one browser tab. Here, you can access the Get Bankruptcy B256 2013 form and modify it however you require, from entering text directly into the document to sketching it on a digital sticky note and attaching it to the document. Uncover tools that will simplify your paperwork without additional effort.

Click on the Get form button to prepare your Get Bankruptcy B256 2013 documentation quickly and start altering it right away. In the editing mode, you can effortlessly fill in the template with your information for submission. Just click on the field you wish to change and input the details instantly. The editor's interface does not require any specific skills to manage. Once you finish editing, verify the accuracy of the information again and sign the document. Click on the signature field and follow the prompts to eSign the form in a moment.

Completing Get Bankruptcy B256 2013 forms will never be perplexing again if you know where to find the right template and prepare it with ease. Do not hesitate to give it a try yourself.

- Employ Cross, Check, or Circle tools to highlight the document's details.

- Insert text or fillable text fields using text customization tools.

- Remove, Highlight, or Blackout text sections in the document using the respective tools.

- Include a date, initials, or even an image in the document if needed.

- Make use of the Sticky note tool to comment on the form.

- Apply the Arrow and Line, or Draw tool to introduce visual elements into your document.

While many individuals can file bankruptcy on their own, it requires understanding the legal process involved in Bankruptcy B256. You need to research forms, deadlines, and regulations, which can be complicated. Beginners may find this process overwhelming, so seeking assistance from services like USLegalForms can make the experience smoother and more successful.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.