Loading

Get Mi B20a 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI B20A online

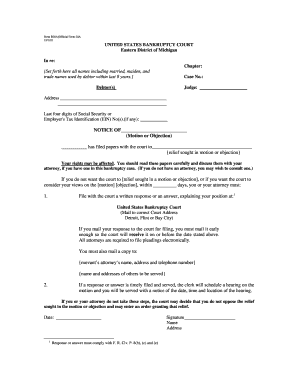

The MI B20A is an important document used in bankruptcy cases within the Eastern District of Michigan. This guide provides a comprehensive overview of how to fill out the MI B20A online, ensuring that users can complete the form accurately and efficiently.

Follow the steps to complete the MI B20A online.

- Click the ‘Get Form’ button to access the MI B20A online and open it in the editor.

- Fill in the top section with relevant information. Include your full name or names, including any married, maiden, or trade names used in the last eight years. Be thorough to ensure proper identification.

- Enter your case number. This number is unique to your bankruptcy case and can usually be found in any correspondence from the court. Double-check for accuracy.

- Provide the name of the judge overseeing your case as listed in your court documents.

- In the address section, include your current address in its entirety. Accurate contact information is vital for any correspondence regarding your case.

- Input the last four digits of your Social Security number or your Employer's Tax Identification Number, if applicable. This helps in identifying your case without compromising your personal information.

- Clearly state the notice regarding the motion or objection. Specify the relief sought and ensure you articulate your position or intentions in relation to the case.

- Review the instructions regarding filing a response. Note the designated timeframe in which you or your attorney must file a written response with the court.

- Make sure to include the correct court address where filings should be sent, whether it is Detroit, Flint, or Bay City.

- Provide the necessary contact information for the movant’s attorney and other parties involved to ensure proper service of documents.

- Finally, review the completed form for accuracy and completeness. Once satisfied with your entries, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your documents online today to ensure an efficient and accurate filing process.

Related links form

In Michigan, any individual with income above certain thresholds is required to file an income tax return. This includes wages, business income, and other earnings. Familiarizing yourself with the MI B20A regulations can help clarify your obligations. If you're unsure, reviewing your tax situation with a professional can provide peace of mind regarding your filing requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.