Loading

Get Mn Supplemental Form 5 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN Supplemental Form 5 online

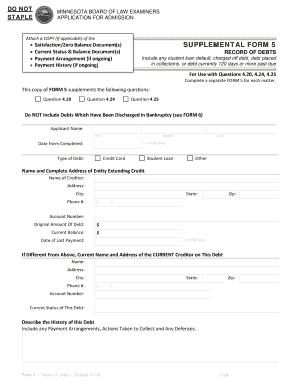

Filling out the MN Supplemental Form 5 is an essential step in the application for admission to the Minnesota Board of Law Examiners. This guide will walk you through each section of the form to ensure you can complete it accurately and efficiently online.

Follow the steps to complete the MN Supplemental Form 5 online.

- Select the ‘Get Form’ button to access the MN Supplemental Form 5 and open it in your preferred online editor.

- Begin by entering your personal information in the designated fields, including your first name, middle name, last name, and the date you completed the form in the specified format (mm/dd/yyyy).

- Under the 'Type of Debt' section, select the appropriate category by marking ‘Credit Card’, ‘Student Loan’, or ‘Other’, depending on the debts you are reporting.

- Provide the name and complete address of the creditor. Fill in the name of the creditor, their address, city, state, and zip code, as well as a contact phone number.

- Input your account number, the original amount of the debt, and the current balance in the respective fields provided.

- Specify the date of your last payment using the mm/dd/yyyy format.

- If applicable, indicate the current name and address of the creditor if it differs from the one provided earlier.

- Complete the field for the current status of the debt, ensuring you provide accurate and truthful information.

- Describe the history of this debt in detail. Include any payment arrangements made, actions taken to collect the debt, and any defenses you may have.

- Once all fields are filled out accurately, review the entire form for any errors. You can then save changes, download a copy, print it, or share the form as needed.

Complete your MN Supplemental Form 5 online today to streamline your application process.

Related links form

The highest income to qualify for SNAP benefits, including in Minnesota, is based on the federal guidelines for your household size. These limits change periodically, so it's essential to refer to the most recent data. You can find up-to-date information on qualifying income by checking the MN Supplemental Form 5 provided by the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.