Get Ne Form Cc 3:3 1998-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

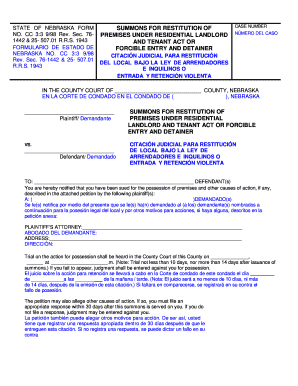

Tips on how to fill out, edit and sign NE Form CC 3:3 online

How to fill out and sign NE Form CC 3:3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

While applying legal documents is overall a stressful and tedious procedure, there is an possibility to fill in them easily with the help of the US Legal Forms solution. It provides you with the NE Form CC 3:3 and guides through the overall process, so you really feel positive about due completion

Stick to the steps to fill out NE Form CC 3:3:

-

Open the form using the feature-rich online editor to embark on filling it out.

-

Follow the green arrow on the left part of your page. It will establish the fields you must fill with an inscription Fill.

-

When you insert the necessary data, the inscription on the green arrow will change to Next. Once you click on it, it is going to redirect you to another fillable field. This will ensure you is not going to skip any fields.

-

Sign the form with the e-signing tool. Draw, type, or scan your signature, whatever suits you better.

-

Click on Date to place the current date on the NE Form CC 3:3. It will probably be completed automatically.

-

Optionally check out the recommendations and tips to ensure that you haven?t missed anything and check the format.

-

When you have finished accomplishing the sample, press Done.

-

Download the form to your device.

Fill in NE Form CC 3:3 on US Legal Forms even on the go and from any gadget.

How to edit NE Form CC 3:3: customize forms online

Finishing papers is easy with smart online instruments. Eliminate paperwork with easily downloadable NE Form CC 3:3 templates you can edit online and print out.

Preparing documents and forms must be more reachable, whether it is a regular component of one’s profession or occasional work. When a person must file a NE Form CC 3:3, studying regulations and instructions on how to complete a form properly and what it should include might take a lot of time and effort. Nevertheless, if you find the right NE Form CC 3:3 template, completing a document will stop being a challenge with a smart editor at hand.

Discover a broader range of features you can add to your document flow routine. No need to print out, fill out, and annotate forms manually. With a smart modifying platform, all of the essential document processing features will always be at hand. If you want to make your work process with NE Form CC 3:3 forms more efficient, find the template in the catalog, click on it, and discover a less complicated method to fill it in.

- If you need to add text in a random part of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you want.

- Take advantage of the Highlight tool to stress the key parts of the form. If you need to hide or remove some text parts, utilize the Blackout or Erase instruments.

- Customize the form by adding default graphic components to it. Use the Circle, Check, and Cross instruments to add these components to the forms, if required.

- If you need additional annotations, use the Sticky note tool and place as many notes on the forms page as required.

- If the form requires your initials or date, the editor has instruments for that too. Reduce the chance of errors by using the Initials and Date tools.

- It is also easy to add custom graphic components to the form. Use the Arrow, Line, and Draw instruments to customize the file.

The more instruments you are familiar with, the better it is to work with NE Form CC 3:3. Try the solution that provides everything necessary to find and edit forms in a single tab of your browser and forget about manual paperwork.

Filling out step 3 on your W-4 requires you to calculate the number of dependents you will claim. First, determine your qualified dependents based on IRS guidelines. Then, insert that number on the form to ensure your employer withholds the correct amount of tax. For guidance, refer to the NE Form CC , which provides valuable insights.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.