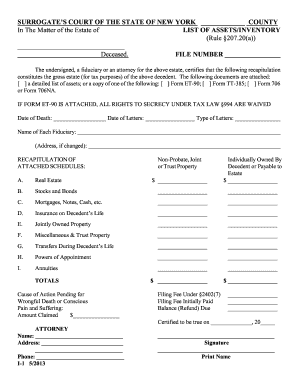

Get Ny I-1 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY I-1 online

How to fill out and sign NY I-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

While declaring legal documents is generally a nerve-racking and time-intensive procedure, it comes with an chance to fill in them at ease with the help of the US Legal Forms service. It offers you the NY I-1 and guides through the entire procedure, therefore you really feel confident in due completion

Stick to the steps to complete NY I-1:

-

Open the form with the feature-rich on-line editor to embark on filling it.

-

Follow the green arrow on the left side of your page. It will point out the fields you should complete with an inscription Fill.

-

Once you place the needed information, the inscription on the green arrow will change to Next. If you click on it, it is going to redirect you to the next fillable field. This will likely ensure that you will not miss any fields.

-

Sign the template using the e-signing instrument. Draw, type, or scan your signature, whatever fits you better.

-

Select Date to put the current date on the NY I-1. It will be accomplished automatically.

-

Optionally check out the tips and tips to be sure that you haven?t missed anything important and check the format.

-

When you have accomplished accomplishing the form, hit Done.

-

Download the document to the device.

Fill in NY I-1 on US Legal Forms even on the go and from any gadget.

How to edit NY I-1: customize forms online

Pick a reliable file editing service you can trust. Edit, execute, and certify NY I-1 securely online.

Very often, modifying documents, like NY I-1, can be pain, especially if you received them in a digital format but don’t have access to specialized software. Of course, you can find some workarounds to get around it, but you can end up getting a form that won't meet the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide a smoother and more streamlined way of modifying files. An extensive catalog of document templates that are easy to customize and certify, and make fillable for some individuals. Our solution extends way beyond a collection of templates. One of the best aspects of using our option is that you can edit NY I-1 directly on our website.

Since it's an online-based platform, it saves you from having to download any software program. Plus, not all company rules allow you to download it on your corporate computer. Here's how you can easily and securely execute your forms with our platform.

- Click the Get Form > you’ll be immediately redirected to our editor.

- Once opened, you can kick off the editing process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date option to add a particular date to your document.

- Add text boxes, pictures and notes and more to complement the content.

- Use the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to generate and add your legally-binding signature.

- Hit DONE and save, print, and pass around or download the output.

Forget about paper and other ineffective ways of modifying your NY I-1 or other files. Use our solution instead that combines one of the richest libraries of ready-to-customize forms and a powerful file editing option. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

The difference between NYS 45 and NYS-1 lies in their functions: NYS-1 focuses on periodic payments of withholding taxes, while NYS 45 summarizes the wages and taxes withheld for the entire year. Thus, NYS-1 is filed more frequently, whereas NYS 45 is an annual report. Recognizing this helps employers manage their tax obligations effectively. For thorough guidance, consider consulting uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.