Loading

Get Vt Form 426 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VT Form 426 online

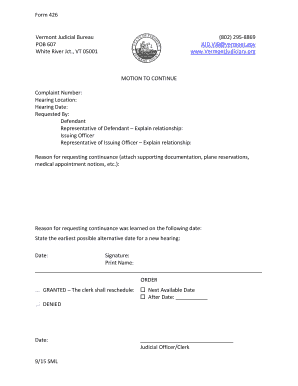

Filling out the VT Form 426 is an important process for those seeking a continuance in their judicial proceedings. This guide will provide clear, step-by-step instructions to help users navigate each section of the form effectively.

Follow the steps to complete the VT Form 426 online

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering the complaint number in the designated field. This number is crucial for identifying your case in the judicial system.

- Next, fill in the hearing location. This information indicates where the original hearing was scheduled to take place.

- Specify the hearing date in the provided field. This date should reflect the original schedule set for your hearing.

- Identify the individual requesting the continuance by checking the appropriate box: Defendant, Representative of Defendant, Issuing Officer, or Representative of Issuing Officer. If applicable, provide an explanation of the relationship in the space provided.

- State the reason for requesting the continuance. It is important to attach any supporting documentation, such as plane reservations or medical appointment notices, that validate your request.

- Indicate the date when you learned of the reason for the continuance request. This helps the court understand the timeline of your situation.

- Propose the earliest possible alternative date for the new hearing. Ensure this date aligns with your availability.

- Sign the form in the designated signature field. After signing, print your name below your signature to confirm the request.

- Review the entire form for accuracy and completeness. Once satisfied, proceed to save changes, download, print, or share the form as needed.

Complete your documents online now for a smoother process.

Related links form

A Vermont property tax rebate provides a refund based on the amount of property tax a homeowner pays relative to their income. Eligibility is determined using specific criteria and your completed VT Form 426. This rebate works to ease the financial burden of property taxes for qualifying homeowners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.