Loading

Get Co Dor 104 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DoR 104 online

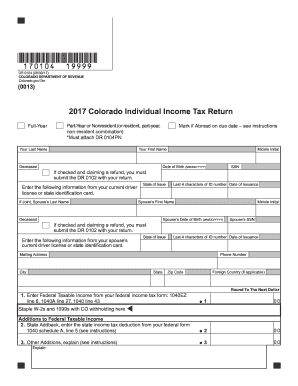

Filing your Colorado Individual Income Tax Form 104 can be straightforward with the right guidance. This guide provides clear, step-by-step instructions tailored to help you successfully complete the form online, ensuring that you submit accurate information.

Follow the steps to complete the CO DoR 104 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete your personal information. Fill in your last name, first name, middle initial, date of birth, and social security number (SSN). If filing jointly, include your spouse's details, including their SSN.

- Provide your address and phone number. Ensure that your mailing address is current and accurate for any correspondence.

- Input your federal taxable income as stated on your federal income tax form. If necessary, include any state addbacks and other additions as per the instructions outlined on the form.

- Fill in the subtractions section, including any state income tax refunds and nontaxable income. Ensure all relevant amounts are entered correctly.

- Calculate your total taxable income, modified adjusted gross income for TABOR, and expected taxes. Ensure to follow the calculations accurately to avoid errors.

- Review and fill in the Tax, prepayments, and credits section. This includes any non-refundable credits and other deductions that may apply to your situation.

- Provide details on any owed taxes and any voluntary contributions if applicable.

- If opting for a refund or to direct deposit, include relevant bank account details. Otherwise, check the appropriate method for payment.

- Complete the final sections including signatures and certifications. Ensure that both partners sign if filing jointly.

- Once you have reviewed all information for accuracy, proceed to save changes, download, print, or share the completed form as necessary.

Complete your Colorado Individual Income Tax Form 104 online today for a smooth filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To fill out a withholding exemption form, begin with the CO DoR 104 form instructions available on the Colorado Department of Revenue site. Clearly state your eligibility for exemption based on your personal tax situation. Carefully fill out the relevant sections, ensuring that all information is accurate. This helps prevent unnecessary tax withholdings and keeps your finances on track.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.