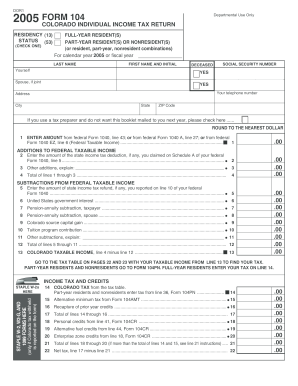

Get Co Dor 104 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO DoR 104 online

How to fill out and sign CO DoR 104 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax filing period commenced unexpectedly or you merely overlooked it, it may likely lead to issues for you.

CO DoR 104 isn’t the most straightforward form, yet you shouldn't have any cause for concern regardless.

With our robust digital solution and its helpful tools, completing CO DoR 104 becomes easier. Don’t hesitate to utilize it and spend more time on hobbies and interests instead of on file preparation.

- Access the document using our premium PDF editor.

- Complete all the necessary information in CO DoR 104, using the fillable sections.

- Include images, marks, checkboxes, and text fields, if applicable.

- Repeated information will be automatically populated after the initial entry.

- If you encounter any confusion, utilize the Wizard Tool. You will receive guidance for easier submission.

- Remember to include the application date.

- Create your individual signature once and place it in all required spots.

- Review the information you've entered. Amend any errors as needed.

- Click Done to finish editing and select how you will submit it. You will find options to use digital fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud services like Google Drive, OneDrive, etc.

How to modify Get CO DoR 104 2005: personalize forms on the web

Choose a dependable document editing tool you can trust. Alter, finish, and authorize Get CO DoR 104 2005 securely online.

Often, modifying forms, such as Get CO DoR 104 2005, can be challenging, especially if obtained online or through email without access to specialized applications. While there are workarounds available, they may lead to a document that does not fulfill the submission criteria. Relying on a printer and scanner is also inefficient as it consumes time and resources.

We provide a more seamless and effective method for altering documents. A vast selection of form templates that are easy to modify and certify, and can then be made fillable for others. Our service offers much more than just templates. One of the greatest advantages of using our solution is your ability to edit Get CO DoR 104 2005 directly on our platform.

Being a browser-based service, it eliminates the need to download any software. Furthermore, not all corporate policies permit downloading on your work laptop. Here’s the most straightforward way to conveniently and securely complete your forms with our service.

Move away from paper and other outdated methods of completing your Get CO DoR 104 2005 or other documents. Opt for our solution instead, which includes one of the most extensive libraries of editable templates and a robust document editing capability. It's user-friendly and secure, and can save you significant time! Don't just take our word for it, experience it for yourself!

- Click the Get Form > you will be promptly sent to our editing tool.

- Once open, you can begin the editing procedure.

- Select checkmark or circle, line, arrow and cross and other tools to mark up your form.

- Choose the date option to insert a specific date into your document.

- Include text boxes, images, and notes among other elements to enhance the content.

- Make use of the fillable fields option on the right for adding fillable {fields.

- Select Sign from the top menu to create and attach your legally-recognized signature.

- Click DONE and save, print, share, or download the final {file.

Related links form

The A1040 tax form is a standard individual income tax form used by taxpayers to report their annual income to the federal government. While this form is not the same as the CO DoR 104, understanding both forms helps in accurately reporting your income and calculating any tax liabilities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.