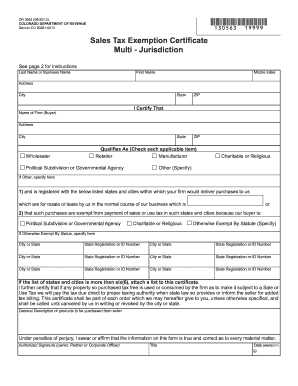

Get Co Dor Dr 0563 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO DoR DR 0563 online

How to fill out and sign CO DoR DR 0563 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period commenced unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you.

CO DoR DR 0563 is not the most straightforward one, but you have no cause for concern in any scenario.

With this comprehensive digital solution and its useful tools, finalizing CO DoR DR 0563 becomes more manageable. Don't hesitate to utilize it and invest more time in hobbies and interests instead of document preparation.

- Access the file using our robust PDF editor.

- Input the necessary information in CO DoR DR 0563, utilizing fillable fields.

- Insert visuals, crosses, checks and text boxes, if required.

- Repetitive information will be populated automatically after the initial entry.

- If you encounter issues, utilize the Wizard Tool. It will provide valuable hints for a much simpler completion.

- Remember to include the application date.

- Create your distinctive e-signature once and place it in all required fields.

- Review the information you've entered. Rectify errors if needed.

- Click on Done to finalize changes and select how you will send it. You have options to use online fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud services like Google Drive, OneDrive, etc.

How to modify Get CO DoR DR 0563 2013: personalize forms on the internet

Select a dependable document editing service you can trust. Alter, execute, and endorse Get CO DoR DR 0563 2013 securely online.

Frequently, adjusting forms, such as Get CO DoR DR 0563 2013, poses difficulties, especially if they were obtained online or through email but you lack access to specialized tools. Naturally, there are some alternatives to navigate around this, but you run the risk of producing a form that may not fulfill the submission standards. Using a printer and scanner is not a viable option either as it consumes significant time and resources.

We offer a more straightforward and effective method for altering documents. An extensive selection of document templates that are easy to adapt and authenticate, and then make fillable for others. Our solution goes far beyond just a collection of templates. One of the foremost advantages of utilizing our platform is that you can amend Get CO DoR DR 0563 2013 directly on our site.

Being an online-based solution prevents the necessity of downloading any software. Furthermore, not all corporate policies allow you to install it on your work laptop. Here’s how you can easily and securely process your forms using our platform.

Put aside paper and other outdated methods of executing your Get CO DoR DR 0563 2013 or other forms. Leverage our tool instead, which boasts one of the most comprehensive collections of ready-to-edit templates and a powerful document editing feature. It's efficient and secure, and can save you a significant amount of time! Don’t just take our word for it, give it a try yourself!

- Click the Get Form > you’ll be promptly taken to our editor.

- Once loaded, you can commence the customization phase.

- Select checkmark or circle, line, arrow and cross and additional options to annotate your document.

- Choose the date option to insert a specific date into your template.

- Include text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to generate fillable {fields.

- Select Sign from the upper toolbar to create your legally-binding signature.

- Press DONE and save, print, and share or retrieve the completed {file.

Related links form

Businesses and individuals who incur expenses that fall under taxable categories may qualify for a sales tax deduction in Colorado. This includes those who make purchases or incur costs related to their exempt purposes as described in CO DoR DR 0563. To claim your deduction accurately, maintaining thorough records of applicable expenses is essential. Consider utilizing resources like US Legal Forms for guidance on obtaining the necessary documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.