Get Co Dor Dr 5714 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Dr 5714 form pdf online

How to fill out and sign Form 5714 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

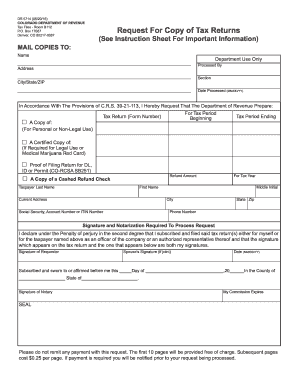

If the tax period commenced unexpectedly or perhaps you simply overlooked it, it might potentially lead to issues for you. CO DoR DR 5714 is not the simplest form, but you have no cause for concern in any situation.

By utilizing our user-friendly solution, you'll discover how to complete CO DoR DR 5714 even in circumstances of urgent time scarcity. The only requirement is to adhere to these straightforward instructions:

With our comprehensive digital solution and its beneficial tools, finishing CO DoR DR 5714 becomes more convenient. Don’t hesitate to give it a try and enjoy more time on hobbies and interests rather than document preparation.

- Open the document in our effective PDF editor.

- Complete all the information necessary in CO DoR DR 5714, utilizing the fillable fields.

- Incorporate images, crosses, checkboxes, and text boxes, if desired.

- Repeating sections will be automatically filled after the first entry.

- If you encounter any obstacles, activate the Wizard Tool. You will receive handy advice for easier submission.

- Always remember to include the application date.

- Create your distinctive signature once and place it in the specified fields.

- Review the details you have entered. Rectify errors if necessary.

- Click Done to finish editing and choose how you will submit it. There is an option to use digital fax, USPS, or email.

- You can also save the document to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

How to modify Get CO DoR DR 5714 2016: personalize forms online

Provide the appropriate document management tools at your disposal.

Carry out Get CO DoR DR 5714 2016 with our reliable solution that merges editing and eSignature capabilities.

If you wish to finalize and validate Get CO DoR DR 5714 2016 online without any hassle, then our online cloud-based solution is the ideal choice. We offer a comprehensive template-based selection of ready-to-use forms you can modify and complete online.

Modify and comment on the template

The upper toolbar contains the tools that enable you to emphasize and obscure text, excluding images and image elements (lines, arrows, checks, etc.), sign, initial, and date the form, among others.

Organize your documents

- Moreover, you don't have to print the form or utilize external solutions to make it fillable.

- All essential tools will be readily accessible for your use upon opening the file in the editor.

- Let's explore our online editing tools and their main features.

- The editor boasts an intuitive interface, ensuring that learning to use it won't consume much of your time.

- We’ll review three primary sections that allow you to:

Related links form

Calculating the 183 day rule involves tracking the number of days you physically reside in Colorado within a calendar year. You must count every day you spend in the state, including partial days. Accurate calculation is vital for your tax status; therefore, when preparing your filings with CO DoR DR 5714, ensure your day count is precise.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.