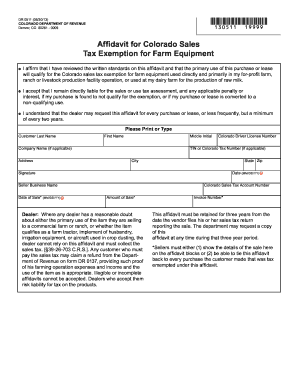

Get Co Dr 0511 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO DR 0511 online

How to fill out and sign CO DR 0511 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period commenced abruptly or perhaps you simply overlooked it, this may lead to complications for you.

CO DR 0511 isn't the simplest form, but there's no need for alarm regardless.

With our potent digital solution and its helpful features, filling out CO DR 0511 is simplified. Don’t hesitate to try it out and spend more time on your passions rather than document preparation.

- Access the document in our robust PDF editor.

- Complete the required information in CO DR 0511, using the fillable fields.

- Insert images, check marks, and text boxes, as necessary.

- Repeated information will be populated automatically after the initial entry.

- If you encounter any difficulties, utilize the Wizard Tool. You'll receive hints for easier completion.

- Always remember to add the application date.

- Create your unique signature once and place it in the appropriate sections.

- Review the entered information. Amend any errors if necessary.

- Press Done to complete your modifications and select how you wish to send it. Options include digital fax, USPS, or email.

- You can download the file for printing later or upload it to cloud storage platforms like Dropbox, OneDrive, etc.

How to modify Get CO DR 0511 2013: personalize forms online

Utilize our robust online document editor effectively while finishing your paperwork. Fill out the Get CO DR 0511 2013, focus on the key details, and smoothly make any additional tweaks to its content.

Completing paperwork digitally is not just efficient but also provides the opportunity to modify the template according to your preferences. If you're preparing to work on Get CO DR 0511 2013, think about finalizing it with our comprehensive online editing features. Whether you make a mistake or input the required information into the incorrect field, you can easily adjust the document without the necessity to restart it from the beginning as you would during manual completion.

Moreover, you can highlight the vital information in your paperwork by marking specific parts of the content with colors, underlining, or encircling them.

Our powerful online solutions are the most straightforward way to finish and adjust Get CO DR 0511 2013 to meet your preferences. Use it to handle personal or business paperwork from anywhere. Access it in a browser, make any modifications to your forms, and return to them at any future time — they will all be securely stored in the cloud.

- Open the file in the editor.

- Input the necessary information in the empty fields using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don't overlook any required fields in the template.

- Encircle some of the crucial details and add a URL to it if necessary.

- Utilize the Highlight or Line options to emphasize the most significant pieces of content.

- Select colors and thickness for these lines to enhance the professionalism of your form.

- Erase or blackout the information you don't want others to see.

- Replace sections of content that contain errors and input the text that you need.

- Conclude editing with the Done option once you verify that everything is accurate in the document.

Related links form

To obtain your Colorado 1099-G form, you can request it from the Colorado Department of Revenue or check their online portal. This form reports any state tax refunds and is essential for accurate tax filing. Make sure to include relevant details, especially regarding agricultural income related to CO DR 0511.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.