Loading

Get Co Dr 0511 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 0511 online

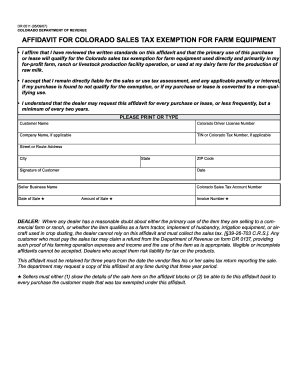

The CO DR 0511 form is an affidavit for Colorado sales tax exemption for farm equipment. This guide provides a step-by-step approach, ensuring users can successfully fill it out online, understanding each section and its requirements.

Follow the steps to complete the CO DR 0511 online.

- Press the ‘Get Form’ button to access the CO DR 0511 form and open it in the digital editor.

- Begin by entering your full name in the 'Customer Name' field. Ensure all information is legible.

- Input your Colorado Driver License Number in the designated field. If applicable, provide the company name you represent.

- Fill in your Tax Identification Number (TIN) or Colorado Tax Number, if you have one. This may be necessary for the exemption.

- Complete the 'Street or Route Address' section with your home or business address where the equipment will be used.

- Enter your city, state (which should be Colorado), and ZIP code correctly.

- Sign the form in the 'Signature of Customer' field, confirming the information you provided is accurate.

- Indicate the date you are filling out the form for records.

- Provide details of the seller business name and their Colorado Sales Tax Account Number in their respective fields.

- Include the date of sale, invoice number, and amount of sale in the fields labeled accordingly.

- Review all entries for accuracy and completeness, as incomplete forms may not be accepted.

- Once all sections are filled and verified, save changes, and download or print the completed CO DR 0511 form as needed.

Complete your documents online today to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Qualifying for tax exemptions usually involves meeting specific criteria related to the use of your property or organization. You may need to present documentation that proves your eligibility based on local, state, and federal guidelines. Utilizing forms like CO DR 0511 can clarify the process and provide you with the essential information required for a successful application.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.