Loading

Get Co Dr 6596 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 6596 online

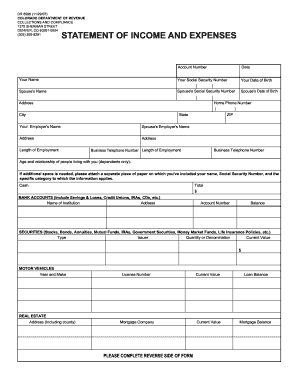

Filling out the CO DR 6596, or the Statement of Income and Expenses, online can provide a streamlined way to report your financial status to the Colorado Department of Revenue. This guide offers step-by-step instructions to ensure that you complete the form accurately.

Follow the steps to fill out the CO DR 6596 with ease.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your account number, the date, and your personal information, including your name, Social Security Number, and date of birth.

- Fill in your spouse's information if applicable, providing their name, Social Security Number, and date of birth.

- Complete the sections for home phone number and your address, including state and city.

- Provide details about your employment and your spouse's employment, including the employer's name and business telephone number.

- List the ages and relationships of people living with you who are dependents.

- In the cash section, enter the total amount available.

- Fill out the bank accounts section by listing the names of the institutions, address, account number, and balances for each account.

- Provide details about securities held, including type, issuer, quantity or denomination, and current value.

- In the motor vehicles section, enter the year and make, license number, current value, and loan balance for each vehicle.

- Complete the mortgage information by providing the company name, current value, and mortgage balance.

- For real estate, list the address, including the county.

- Fill out the monthly income section, detailing each source of income along with the corresponding amounts.

- Report your monthly expenses in the next section, ensuring each category is filled out with reasonable amounts.

- Provide any additional information about expected changes in income or employment in the designated section.

- Sign the declaration statement, including your signature and your spouse's signature if applicable, along with the date.

- Finally, review your entries for accuracy and save your changes, or download, print, or share the completed form as needed.

Start completing the CO DR 6596 online today to ensure your statements are submitted accurately and efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To set up an S Corp in Colorado, start by registering your business with the Secretary of State. Make sure to comply with the guidelines and requirements related to CO DR 6596 for tax purposes. For further assistance, consider using platforms like uslegalforms that simplify the S Corp formation process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.