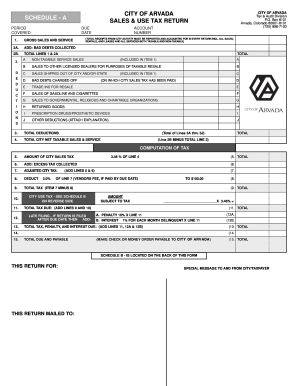

Get Co Sales & Use Tax Return - City Of Arvada

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CO Sales & Use Tax Return - City of Arvada online

How to fill out and sign CO Sales & Use Tax Return - City of Arvada online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax timeframe commenced unexpectedly or perhaps you simply overlooked it, it might likely create issues for you. CO Sales & Use Tax Return - City of Arvada isn't the most straightforward one, but you have no reason for concern in any event.

By utilizing our premier service you will discover the correct method to finalize CO Sales & Use Tax Return - City of Arvada in situations of significant time scarcity. All you need to do is adhere to these basic guidelines:

With this comprehensive digital solution and its expert tools, submitting CO Sales & Use Tax Return - City of Arvada becomes more convenient. Don’t hesitate to try it and have more time for hobbies and interests instead of document preparation.

Launch the document in our robust PDF editor.

Input the required information in CO Sales & Use Tax Return - City of Arvada, by employing fillable fields.

Add graphics, ticks, checkmarks and text boxes, if necessary.

Duplicated information will be filled in automatically after the initial entry.

If you encounter any confusion, utilize the Wizard Tool. You will find some suggestions for much simpler submission.

Don’t forget to include the date of application.

Create your unique signature once and place it in all the necessary fields.

Verify the information you have entered. Amend errors if needed.

Press Done to finish editing and select how you will submit it. You have the option to use digital fax, USPS, or electronic mail.

Additionally, you can download the file to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

How to modify Get CO Sales & Use Tax Return - City of Arvada: personalize forms online

Place the correct document alteration tools at your fingertips. Complete Get CO Sales & Use Tax Return - City of Arvada with our reliable solution that includes editing and eSignature capabilities.

If you wish to execute and validate Get CO Sales & Use Tax Return - City of Arvada online effortlessly, then our internet-based solution is the ideal choice. We provide a vast template-based collection of ready-to-use forms you can modify and complete online.

Furthermore, there’s no need to print the form or rely on external options to make it fillable. All the essential tools will be readily accessible once you open the document in the editor.

In addition to the functionalities mentioned above, you can protect your document with a password, add a watermark, convert the document to the needed format, and much more.

Our editor simplifies completing and certifying the Get CO Sales & Use Tax Return - City of Arvada. It enables you to accomplish nearly everything related to handling forms. Additionally, we consistently guarantee that your experience working with documents is secure and adheres to key regulatory standards.

All these factors make utilizing our solution even more pleasurable. Obtain Get CO Sales & Use Tax Return - City of Arvada, implement the required changes and adjustments, and receive it in your preferred file format. Try it out today!

- Adapt and comment on the template

- The upper toolbar contains tools that assist you in emphasizing and obscuring text, without visuals and graphic elements (lines, arrows, checkmarks, etc.), sign, initialize, date the document, and more.

- Arrange your documents

- Utilize the left toolbar if you want to rearrange the document or/and eliminate pages.

- Prepare them for distribution

- If you aim to make the template fillable for others and share it, you can employ the tools on the right to add various fillable fields, signature and date fields, text boxes, etc.

Related links form

Certain items are exempt from sales tax in Colorado, including groceries, certain medical devices, and some agricultural products. Additionally, sales for resale or to non-profit organizations can also be exempt. Familiarizing yourself with these exemptions can assist you in accurately completing the CO Sales & Use Tax Return - City of Arvada.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.