Get Co Tr-1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

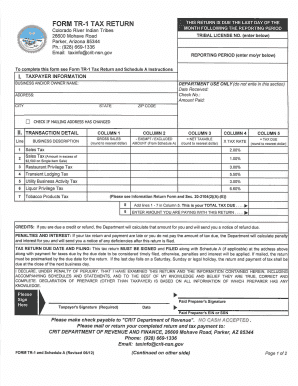

Tips on how to fill out, edit and sign CO TR-1 online

How to fill out and sign CO TR-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period commenced suddenly or perhaps you simply overlooked it, it could likely create difficulties for you.

CO TR-1 is not the simplest form, yet you have no reason to panic regardless.

With this potent digital solution and its handy tools, completing CO TR-1 becomes more convenient. Don’t hesitate to utilize it and spend more time on hobbies and interests instead of document preparation.

- Access the document with our robust PDF editor.

- Complete the necessary information in CO TR-1, using the fillable fields.

- Add images, checkmarks, and text boxes as needed.

- Repeated entries will be populated automatically after the initial submission.

- If you encounter any confusion, enable the Wizard Tool. You will receive helpful hints for easier completion.

- Always remember to input the application date.

- Create your unique electronic signature once and place it in the required spaces.

- Review the information you have entered. Amend any errors if necessary.

- Select Done to finalize editing and choose your delivery method. You can opt for online fax, USPS, or email.

- You can also download the document for later printing or upload it to cloud storage.

How to alter Get CO TR-1 2012: personalize forms online

Utilize our extensive online document editor while finalizing your paperwork. Complete the Get CO TR-1 2012, highlight the most critical details, and easily make any other necessary changes to its content.

Creating documents digitally not only saves time but also provides the chance to adjust the template to meet your needs. If you’re preparing to work on Get CO TR-1 2012, think about completing it with our detailed online editing tools. Whether you make a mistake or place the required information in the wrong field, you can quickly adjust the document without having to start over as you would with manual entry. Furthermore, you can emphasize essential information in your paperwork by highlighting certain sections with colors, underlining them, or encircling them.

Follow these brief and straightforward steps to complete and modify your Get CO TR-1 2012 online:

Our powerful online tools are the best way to complete and adjust Get CO TR-1 2012 to fit your needs. Use it to prepare personal or business documents from any location. Open it in a web browser, modify your forms as needed, and return to them at any time in the future - all of them will be securely saved in the cloud.

- Access the document in the editor.

- Input the necessary information in the blank sections using Text, Check, and Cross tools.

- Follow the document guide to ensure you do not overlook any compulsory fields in the template.

- Circle some key details and add a URL to it if required.

- Employ the Highlight or Line features to accentuate the most crucial information.

- Choose colors and thickness for these lines to enhance the appearance of your form.

- Remove or obscure information you wish to conceal from others.

- Replace sections of content that have errors and input the necessary text.

- Conclude adjustments with the Done option after confirming the document's accuracy.

Related links form

The IRS considers a charity to be an organization that operates for religious, charitable, scientific, literary, or educational purposes. These organizations must meet specific criteria to achieve tax-exempt status. Filing the CO TR-1 is one way to ensure your charity remains compliant with IRS regulations. Understanding these criteria helps organizations better serve their communities and fulfill their missions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.