Get Ct Au-724 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT AU-724 online

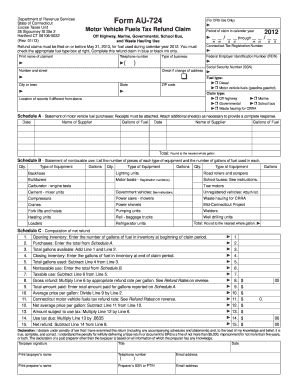

The CT AU-724 is a Motor Vehicle Fuels Tax Refund Claim form used to request a refund for taxes paid on specific motor vehicle fuels. This guide provides clear and structured steps to assist you in accurately completing the form online for your convenience.

Follow the steps to successfully complete your CT AU-724 refund claim.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your full name and contact information, including your telephone number. This step ensures that the Department of Revenue Services can reach you if needed.

- Indicate your Connecticut Tax Registration Number, Federal Employer Identification Number (FEIN), or Social Security Number (SSN) in the space provided to identify your tax account.

- Specify if there has been a change of address by checking the appropriate box. Then, provide your current address details including the number and street, city or town, state, and ZIP code.

- Select the type of fuel involved in your claim by checking the corresponding box for either diesel or motor vehicle fuels (gasoline-gasohol).

- Select the claim type by checking the appropriate box for off highway, marine, governmental, school bus, or waste hauling, based on how the fuel was utilized.

- Complete Schedule A by entering the date of purchase, name of the supplier, and gallons of fuel purchased. Ensure to attach all relevant receipts or invoices.

- Fill out Schedule B to report nontaxable fuel use by listing the quantity and type of equipment along with the gallons of fuel used.

- Proceed to Schedule C to compute your net refund. Carefully follow the instructions provided to calculate each line accurately, making sure to round amounts as directed.

- Review the declaration statement, sign it, and provide your title and printed name. If a paid preparer assisted you, include their information as required.

- After ensuring all sections are completed and accurate, save your changes, then download, print, or share the form as needed.

Complete your CT AU-724 refund claim online today for a hassle-free filing experience.

Get form

Related links form

Connecticut fuel tax rates can vary and are an important aspect of budgeting for fuel expenses in CT AU-724. The state imposes taxes on various types of fuel, including gasoline and diesel, with rates that may change periodically. To obtain the most accurate current rates, checking with the Connecticut Department of Revenue Services is recommended. Staying updated helps you manage your fuel costs effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.