Loading

Get Ct Cert-115 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CERT-115 online

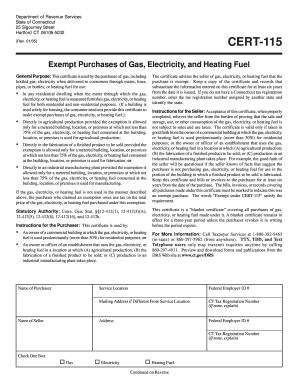

The CT CERT-115 form is used for exempt purchases of gas, electricity, and heating fuel in Connecticut. This guide provides you with clear and detailed steps to complete the form efficiently online.

Follow the steps to effectively complete the CT CERT-115 online.

- Press the 'Get Form' button to access the CT CERT-115 and open it in your online document editor.

- Begin filling in the section for 'Name of Purchaser' with the full name of the person or entity making the exempt purchase.

- Fill out 'Name of Seller' to provide the name of the seller from whom the gas, electricity, or heating fuel is being purchased.

- In the next fields, enter the service location address, including the Federal Employer ID Number (if applicable).

- If your mailing address is different from the service location, provide the correct mailing address and Federal Employer ID Number.

- Indicate your CT Tax Registration Number. If you do not have one, explain why in the available space.

- Select one option by checking the appropriate box for the type of energy — Gas, Electricity, or Heating Fuel.

- If applicable, check the appropriate box for specific exemptions, such as for governmental entities or nonprofit organizations, and provide any requested certificate numbers.

- Complete the section regarding the use of energy in production or fabrication. Certify the intended use by checking the relevant box.

- Describe how you calculated the percentage of energy used for exempt purposes in the provided text field.

- List the products being produced, fabricated, or manufactured at the location related to the exemption claim.

- Answer whether you currently use Form OR-248 or an exemption permit for fuel purchases, selecting Yes or No.

- In the declaration section, provide your name and an authorized signature, verifying that all information is true to the best of your knowledge.

- Finally, review all the filled information for accuracy. Save your changes, and download, print, or share the completed CT CERT-115 form as needed.

Complete your CT CERT-115 form online today to ensure your exempt purchases are processed smoothly.

Related links form

The Cert 119 form in Connecticut is a tax exemption certificate used primarily for claiming sales and use tax exemption for specific purchases. This form works alongside the CT CERT-115, which provides broader exemptions applicable to most goods and services. It's essential to know how both forms fit into your tax strategy for optimal financial planning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.