Loading

Get Ak Dor 6220 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 6220 online

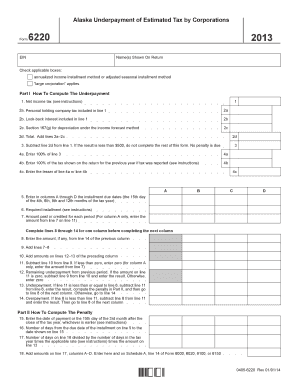

Filling out the AK DoR 6220 form efficiently is essential for accurate reporting of estimated tax underpayment for corporations. This guide provides detailed instructions for completing each section of the form and ensures you have the necessary information at hand.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the AK DoR 6220 form and open it in your editing tool.

- Begin by entering your Employer Identification Number (EIN) and the names shown on the return in the designated fields.

- Check the applicable boxes for the annualized income installment method, adjusted seasonal installment method, or if the 'large corporation' designation applies.

- Move to Part I, where you will compute the underpayment. Start with the net income tax; ensure accuracy based on the latest tax instructions.

- If applicable, include the personal holding company tax in line 2a and any look-back interest in line 2b. Enter the relevant amounts for Section 167(g) depreciation under line 2c.

- Add lines 2a, 2b, and 2c together and note the total on line 2d.

- Subtract line 2d from line 1. If the result is less than $500, you do not need to complete the rest of the form.

- For lines 4a and 4b, enter the appropriate figures based on the previous year's tax return, or 100% of line 3 as indicated.

- Input the installment due dates in columns A through D for the 15th day of the 4th, 6th, 9th, and 12th months.

- Complete the required installment calculations and enter any amounts paid or credited for each period.

- Follow the instructions to fill lines 8 through 14 for each column before moving to the next column.

- In Part II, start calculating the penalty by entering the date of payment in line 15 and determine the number of days since the installment due date.

- Calculate the penalty using the formula provided, applying the rate to the amount on line 13.

- Finally, review all entries before saving your changes, downloading, printing, or sharing the form as needed.

Start completing your AK DoR 6220 form online today for accurate tax management.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file your Alaska Permanent Fund Dividend (PFD) on taxes, report it as income on your tax return. It is essential to check the specific requirements set forth in AK DoR 6220 to ensure you meet all criteria. Using a platform like uslegalforms can simplify this process by providing the necessary forms and guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.