Loading

Get Ct Drs Ct-1040 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-1040 online

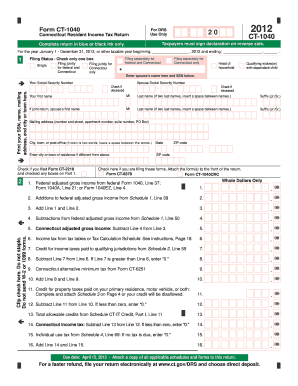

Filing your Connecticut Resident Income Tax Return (CT DRS CT-1040) online can streamline the process and ensure accuracy. This guide provides step-by-step instructions for completing each section of the form to help you efficiently fulfill your tax obligations.

Follow the steps to complete your CT DRS CT-1040 accurately.

- Press the ‘Get Form’ button to access the CT DRS CT-1040 form and open it in your editor.

- Indicate your filing status by checking one box: single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

- Enter your personal information, including your Social Security Number, name, and mailing address. If filing jointly, also provide your spouse's information.

- Fill in your federal adjusted gross income, along with any additions and subtractions as required by the form.

- Calculate your Connecticut adjusted gross income by completing the specified addition and subtraction lines.

- Determine your income tax using the tax tables referenced in the form, and include any credits for income taxes paid to qualifying jurisdictions.

- Report any overpayments due or tax payments made, ensuring to fill in all relevant details for proper processing.

- Sign and date the declaration section, confirming the accuracy of the information provided, and include your daytime telephone number.

- Review all entries for completeness and accuracy before saving your changes, followed by options to download, print, or share the completed form.

Complete your CT DRS CT-1040 online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

No, you cannot e-file an amended CT return at this time. You need to prepare your amended return using the CT-1040X form and send it via mail. Although this process seems outdated compared to electronic filing, it ensures that your changes are recorded accurately. Services like uslegalforms can help you navigate these guidelines for a smooth experience.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.