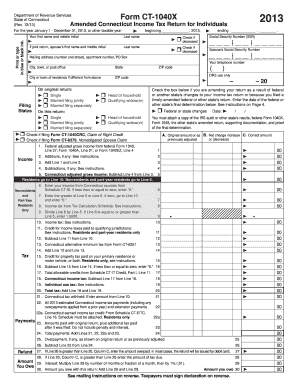

Get Ct Drs Ct-1040x 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-1040X online

How to fill out and sign CT DRS CT-1040X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the fiscal period commenced unexpectedly or perhaps you simply overlooked it, it could likely create issues for you. CT DRS CT-1040X isn’t the easiest form, but you have no reason for concern in any situation.

Utilizing our user-friendly platform, you will discover how to complete CT DRS CT-1040X even in circumstances of significant time scarcity. You just need to adhere to these basic instructions:

With our comprehensive digital solution and its beneficial tools, completing CT DRS CT-1040X becomes more efficient. Don’t hesitate to utilize it and allocate more time to hobbies and interests instead of organizing documents.

- Access the document using our robust PDF editor.

- Complete all the necessary information in CT DRS CT-1040X, utilizing fillable fields.

- Insert images, crosses, checkmarks, and text boxes if necessary.

- Repeated information will be automatically filled after the initial entry.

- If you encounter issues, activate the Wizard Tool. You will receive helpful hints for easier submission.

- Remember to add the date of submission.

- Generate your unique e-signature one time and place it in the required fields.

- Review the details you have entered. Correct any errors if necessary.

- Click on Finish to complete editing and choose how you will send it. You will have the option to use online fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud storage services like Google Drive, OneDrive, etc.

How to modify Get CT DRS CT-1040X 2013: personalize forms online

Choose a dependable file editing solution you can trust. Alter, complete, and endorse Get CT DRS CT-1040X 2013 securely on the web.

Frequently, modifying forms, such as Get CT DRS CT-1040X 2013, can be difficult, particularly if you obtained them online or through email but lack specialized tools. Naturally, you could employ some alternatives to bypass this, yet you run the risk of creating a document that does not meet submission criteria. Using a printer and scanner isn't a viable solution either as it's time-consuming and resource-intensive.

We provide a more seamless and effective method for finalizing documents. Our extensive library of document templates is simple to edit, certify, and make fillable for others. Our platform goes beyond just templates. One of the most beneficial features of using our services is that you can modify Get CT DRS CT-1040X 2013 directly on our site.

Being a web-based solution, it eliminates the need to download any software. Additionally, not all corporate regulations permit you to install it on your work computer. Here’s how you can effortlessly and securely finalize your documents with our platform.

Bid farewell to paper and other inefficient methods for processing your Get CT DRS CT-1040X 2013 or other documents. Opt for our tool instead, which combines one of the most expansive collections of editable forms with robust file editing services. It’s straightforward and secure, and can save you a great deal of time! Don’t just take our word for it, experience it for yourself!

- Click on Get Form > you'll be instantly redirected to our editor.

- Once opened, you can start the customization journey.

- Choose checkmark or circle, line, arrow, and cross among other options to annotate your form.

- Select the date field to insert a specific date into your template.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to add fillable {fields.

- Choose Sign from the top toolbar to create and append your legally-binding signature.

- Click DONE and save, print, share, or download the document.

Related links form

As of now, the amended 1040X form cannot be filed electronically in Connecticut. Taxpayers must fill out the CT DRS CT-1040X and send it through the mail to the Department of Revenue Services. While this might take extra time, it's essential to ensure your amendments are processed correctly. Be sure to check for any future updates regarding e-filing options.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.