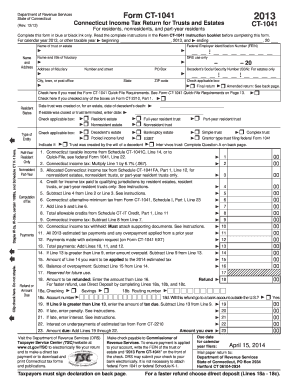

Get Ct Drs Ct-1041 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-1041 online

How to fill out and sign CT DRS CT-1041 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the taxation period commenced unexpectedly or you merely overlooked it, it would likely lead to issues for you. The CT DRS CT-1041 form is not the simplest, but there is no reason for concern in any instance.

By utilizing our expert platform, you will discover how to complete the CT DRS CT-1041 even in scenarios of significant time constraints. You only need to adhere to these straightforward guidelines:

With our robust digital solution and its professional features, filling out CT DRS CT-1041 becomes more efficient. Don't hesitate to utilize it and allocate more time for your interests instead of document preparation.

- Access the document using our specialized PDF editor.

- Input the required information in CT DRS CT-1041, using the fillable fields.

- Incorporate visuals, marks, checkboxes, and text boxes, if necessary.

- Repetitive entries will be filled in automatically following the initial entry.

- If you encounter any issues, activate the Wizard Tool. You will receive helpful hints for easier completion.

- Remember to include the filing date.

- Create your distinct signature once and place it in all the relevant fields.

- Review the information you have entered. Rectify any mistakes if necessary.

- Select Done to complete the editing process and choose your delivery method. You will have the option to use digital fax, USPS, or email.

- You can also download the document to print it later or upload it to cloud storage.

How to modify Get CT DRS CT-1041 2013: personalize forms online

Your swiftly adjustable and tailor-made Get CT DRS CT-1041 2013 template is easily accessible. Capitalize on our archive with an integrated online editor.

Do you delay finishing Get CT DRS CT-1041 2013 because you just don't know where to begin and how to proceed? We empathize with your concerns and have an excellent solution for you that has nothing to do with tackling your procrastination!

Our online repository of ready-to-use templates allows you to browse through and select from thousands of fillable forms designed for various purposes and situations. However, acquiring the file is merely the tip of the iceberg. We provide you with all the essential tools to complete, certify, and modify the form of your choice without departing from our website.

All you have to do is open the form in the editor. Review the wording of Get CT DRS CT-1041 2013 and ensure it's what you’re seeking. Start filling out the template using the annotation tools to give your form a more structured and polished appearance.

In summary, along with Get CT DRS CT-1041 2013, you will receive:

With our comprehensive option, your completed forms are typically legally binding and fully encrypted. We ensure the protection of your most sensitive information.

Get everything you need to create a professional-looking Get CT DRS CT-1041 2013. Make the right decision and explore our system today!

- Insert checkmarks, circles, arrows, and lines.

- Emphasize, conceal, and amend the existing text.

- If the form is meant for others as well, you can incorporate fillable fields and share them for additional parties to complete.

- Once you have finished filling out the template, you can download the file in any available format or select any sharing or delivery options.

- An advanced suite of editing and annotation tools.

- An embedded legally-binding eSignature solution.

- The option to generate forms from scratch or based on the pre-prepared template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for securing your files.

- A range of delivery alternatives for easier sharing and distribution of files.

- Compliance with eSignature regulations that govern the use of eSignature in online transactions.

Related links form

The address for submitting a Connecticut IRS return varies based on the type of return you are filing and whether you are including a payment. It's advisable to refer to the IRS official website or the Connecticut Department of Revenue Services for the specific address linked to your particular situation. Ensuring you use the correct address is crucial for timely processing. If in doubt, consulting additional resources can provide clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.