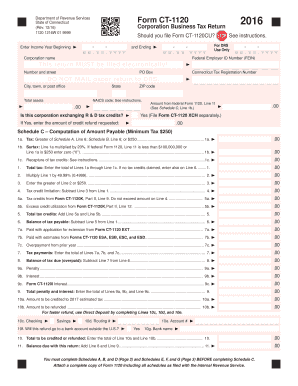

Get Ct Drs Ct-1120 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-1120 online

How to fill out and sign CT DRS CT-1120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period began unexpectedly or perhaps you simply overlooked it, it could likely create issues for you. CT DRS CT-1120 is not the easiest form, but you should not have cause for concern regardless.

Using our user-friendly service, you will discover the optimal approach to complete CT DRS CT-1120 even in cases of severe time constraints. You only need to adhere to these straightforward guidelines:

With this comprehensive digital solution and its useful tools, filling out CT DRS CT-1120 becomes easier. Do not hesitate to try it and allocate more time for hobbies and interests instead of preparing paperwork.

- Launch the file in our expert PDF editor.

- Input the necessary details in CT DRS CT-1120, using the fillable fields.

- Incorporate graphics, checks, tick and text boxes, if applicable.

- Repeated information will be inserted automatically after the first entry.

- If you encounter any confusion, utilize the Wizard Tool. You will receive helpful advice for smoother completion.

- Remember to include the date of submission.

- Create your distinct signature once and place it in all required areas.

- Review the information you have provided. Amend errors if needed.

- Select Done to finalize changes and choose the method of delivery. You can opt for digital fax, USPS, or email.

- You can download the document to print it later or upload it to cloud services like Google Drive, Dropbox, etc.

How to modify Get CT DRS CT-1120 2016: personalize forms digitally

Appreciate the features of the versatile online editor while finishing your Get CT DRS CT-1120 2016. Utilize the variety of tools to swiftly fill in the gaps and deliver the required information promptly.

Creating documents is labor-intensive and expensive unless you possess ready-made fillable forms to complete them electronically. The easiest method to handle the Get CT DRS CT-1120 2016 is by employing our expert and multifunctional online editing solutions. We offer you all the necessary tools for quick form completion and enable you to make any modifications to your templates, tailoring them to any necessities. Furthermore, you can annotate the alterations and leave remarks for others involved.

Here’s what you can accomplish with your Get CT DRS CT-1120 2016 in our editor:

Managing the Get CT DRS CT-1120 2016 in our powerful online editor is the fastest and most efficient means to handle, submit, and share your documentation as per your requirements from anywhere. The tool operates from the cloud so you can reach it from any location on any internet-enabled device. All templates you create or complete are safely stored in the cloud, ensuring you can always access them as needed and feel assured of not losing them. Stop squandering time on manual document completion and eliminate physical paperwork; transition to an online process with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize important details with a preferred color or underline them.

- Hide confidential information using the Blackout tool or simply delete them.

- Insert images to illustrate your Get CT DRS CT-1120 2016.

- Substitute the original text with one that fits your needs.

- Add remarks or sticky notes to notify others about the changes.

- Remove unnecessary fillable areas and assign them to specific individuals.

- Secure the document with watermarks, include dates, and bates numbers.

- Distribute the documents in various formats and save them to your device or the cloud after making adjustments.

Related links form

Yes, you can file your taxes electronically yourself. The online filing system provided by Connecticut is user-friendly and helps you submit your CT-1120 and other tax forms directly. If you prefer assistance or a streamlined process, platforms like uslegalforms can guide you through the filing process to ensure everything is correct.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.