Get Ct Drs Ct-656 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-656 online

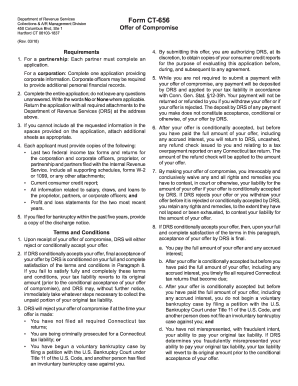

The CT DRS CT-656 form allows individuals and businesses to submit an offer of compromise to the Connecticut Department of Revenue Services. This guide provides a clear, step-by-step approach to completing the form online, ensuring all required information is accurately submitted to facilitate a successful application.

Follow the steps to properly complete the CT DRS CT-656 online.

- Click ‘Get Form’ button to obtain the form and access it in your online editor.

- Begin filling out the taxpayer information section. Enter the name, doing business as (DBA) name, and address of the taxpayer or partnership.

- Input the date of birth and Connecticut Tax Registration Number, along with the Social Security Number or Federal Employer Identification Number of the taxpayer.

- List the number of dependents claimed on your federal income tax return.

- In the financial statement section, provide information regarding your financial situation, including details on loans, credit cards, bank accounts, real estate, automobiles, and other assets.

- Clearly indicate the tax type and periods related to the offer of compromise. If applicable, specify if this bill is under appeal.

- State the amount you offer to pay along with the date by which DRS must receive your payment, which should be within 30 days from acceptance of your offer.

- Review all requirements, terms, and conditions. Ensure that you are aware of the implications of submitting the offer, including possible reversion of tax liability and authorization for DRS to access your credit report.

- Sign and date the declaration, confirming that all information provided is complete and correct. If applicable, ensure that any joint applicants or spouses also sign and date the form.

- Finally, save your completed form, download it for your records, print a copy if necessary, and share it via the appropriate methods to submit your offer.

Complete your CT DRS CT-656 form online today and submit your offer of compromise.

Related links form

A tax ID number and a sales tax number serve different purposes, although they are related. A tax ID identifies your business for federal and state tax purposes, while a sales tax number specifically allows businesses to collect sales tax from customers. Understanding the difference aids you in complying with regulations, which the CT DRS CT-656 can assist you in managing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.