Get Ct Drs Ct-706 Nt Ext 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-706 NT EXT online

How to fill out and sign CT DRS CT-706 NT EXT online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season began unexpectedly or you simply overlooked it, it may likely lead to issues for you.

CT DRS CT-706 NT EXT isn't the easiest one, but you don't have any reason for concern in any event.

With this robust digital solution and its advantageous tools, submitting CT DRS CT-706 NT EXT becomes easier. Don’t hesitate to utilize it and allocate more time to hobbies rather than paperwork preparation.

- Open the document using our sophisticated PDF editor.

- Complete the necessary information in CT DRS CT-706 NT EXT, utilizing fillable fields.

- Add images, checks, tick boxes, and text boxes, if necessary.

- Repeated information will be auto-filled after the initial entry.

- If you encounter difficulties, activate the Wizard Tool. You will receive some guidance for easier submission.

- Always remember to include the filing date.

- Create your distinct e-signature once and place it in all required spots.

- Verify the information you have submitted. Rectify errors if necessary.

- Press Done to finish editing and choose how you will send it. You can opt for digital fax, USPS, or email.

- You have the ability to download the document for later printing or upload it to cloud storage services like Google Drive, OneDrive, etc.

How to modify Obtain CT DRS CT-706 NT EXT 2015: personalize forms on the web

Put the appropriate document modification features at your disposal. Implement Obtain CT DRS CT-706 NT EXT 2015 with our trustworthy tool that includes editing and electronic signature functionalities.

If you aim to implement and endorse Obtain CT DRS CT-706 NT EXT 2015 online without any hassle, then our web-based option is the optimal choice. We offer a rich template-based library of ready-to-utilize documents you can amend and complete online. Furthermore, there is no need to print the form or rely on external tools to make it fillable. All the essential functions will be accessible for your use as soon as you access the file in the editor.

Modify and comment on the template

The upper toolbar includes features that assist you in emphasizing and obscuring text, without graphics and image elements (lines, arrows, checkmarks, etc.), sign, initial, and date the document, among others.

Arrange your files

- Evaluate our online editing features and their main benefits.

- The editor provides a user-friendly interface, so it won’t take long to learn how to navigate it.

- We’ll explore three primary sections that enable you to:

Related links form

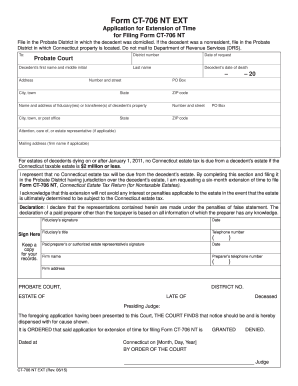

To file a CT estate tax return, complete the CT-706 NT EXT form with the necessary information about the deceased's assets and liabilities. You can submit this return online, which often expedites processing time, or you can send a paper copy via mail to the CT DRS. It's important to ensure all information is accurate and complete to avoid issues. Utilizing US Legal Forms can assist you in navigating the filing process effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.