Loading

Get Ct Drs Ct-941 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-941 online

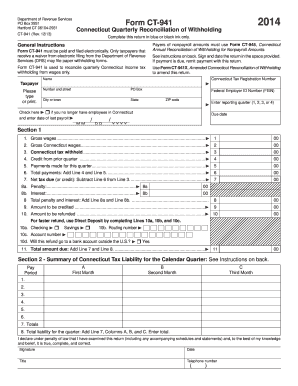

The CT DRS CT-941 form is essential for Connecticut businesses to reconcile quarterly income tax withholding from wages. This comprehensive guide will provide you with step-by-step instructions on how to accurately complete the form online, ensuring compliance with state regulations.

Follow the steps to accurately complete your CT DRS CT-941 online.

- Press the ‘Get Form’ button to obtain the form and access it in your preferred editor.

- Fill in your Connecticut Tax Registration Number, name, address, and Federal Employer ID Number (FEIN). If you no longer have employees in Connecticut, check the appropriate box and enter the date of your last payroll.

- Select the reporting quarter (1, 2, 3, or 4) and the due date for your submission.

- In Section 1, enter the gross wages for all employees during the quarter in Line 1, and gross Connecticut wages in Line 2. Ensure accuracy as this affects tax calculations.

- Record the total Connecticut tax withheld on wages for the quarter in Line 3. This should correspond with Line 8 in Section 2.

- Enter any credit you received from the prior quarter on Line 4, and the total payments made for the current quarter on Line 5.

- Calculate the total payments by adding Line 4 and Line 5. Write this total in Line 6.

- Determine the net tax due (or credit) by subtracting Line 6 from Line 3. Fill this in Line 7.

- If applicable, record any penalties and interest in Lines 8a and 8b. Sum these values in Line 8.

- Enter any amounts you wish to credit toward the next quarter in Line 9 and any refunds in Line 10. If opting for direct deposit, complete Lines 10a, 10b, and 10c.

- Finally, sum the total amount due in Line 11 and review your entries for accuracy.

- Save your changes, and you can choose to download, print, or share the completed form as needed.

Complete your CT DRS CT-941 form online today to ensure timely filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To file a CT 941, you need to complete the appropriate form from the CT DRS. Make sure to follow the guidelines for submission, which can include mailing or electronic options. It's essential to file accurately and on time to avoid penalties and ensure compliance with state regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.