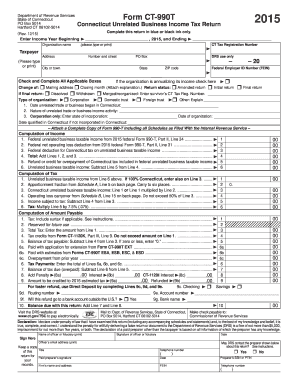

Get Ct Drs Ct-990t 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-990T online

How to fill out and sign CT DRS CT-990T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period began unexpectedly or perhaps you simply overlooked it, it could certainly lead to difficulties for you. CT DRS CT-990T is not the most straightforward form, but there is no reason for alarm in any case.

By utilizing our expert solution, you will discover the correct approach to complete CT DRS CT-990T in situations of urgent time shortage. The only requirement is to adhere to these basic suggestions:

With our comprehensive digital solution and its professional tools, completing CT DRS CT-990T becomes more efficient. Don't hesitate to take advantage of it and devote more time to hobbies and passions instead of preparing paperwork.

Access the document with our expert PDF editor.

Enter the necessary information in CT DRS CT-990T, using the fillable fields.

Include images, checks, tick marks, and text boxes, if required.

Repeated fields will be populated automatically after the initial input.

If you encounter any uncertainties, activate the Wizard Tool. You will receive some guidance for easier submission.

Remember to include the filing date.

Create your distinct e-signature once and place it in all the required spaces.

Verify the information you have entered. Make corrections if needed.

Click on Done to finalize your edits and choose how you want to submit it. You will have the option to use online fax, USPS, or email.

You can also download the document to print it later or upload it to cloud storage.

How to modify Get CT DRS CT-990T 2015: personalize forms online

Utilize the appropriate document management tools at your convenience. Implement Get CT DRS CT-990T 2015 with our reliable service that merges editing and eSignature features.

If you wish to implement and sign Get CT DRS CT-990T 2015 online effortlessly, then our cloud-based solution is the perfect option. We offer an extensive template-based collection of ready-to-edit forms that you can complete online. Additionally, there's no need to print the form or rely on third-party solutions to make it fillable. All essential features will be at your fingertips once you access the file in the editor.

Let’s explore our online modification tools and their key features. The editor features an intuitive interface, so it won't take long to understand how to use it. We’ll examine three primary sections that allow you to:

In addition to the previously mentioned functionalities, you can protect your file with a password, add a watermark, convert the file to the required format, and much more.

Our editor makes filling out and validating the Get CT DRS CT-990T 2015 extremely easy. It allows you to manage virtually every aspect of document handling. Furthermore, we consistently ensure that your experience modifying documents is secure and adheres to the primary regulatory standards. All these elements enhance the enjoyment of utilizing our tool.

Obtain Get CT DRS CT-990T 2015, make the necessary adjustments and modifications, and receive it in your preferred file format. Test it out today!

- Revise and comment on the template

- The upper toolbar includes features that assist you in emphasizing and obscuring text, excluding images and graphics (lines, arrows, checkmarks, etc.), signing, initialing, dating the form, and more.

- Organize your documents

- Utilize the left toolbar if you want to rearrange the form or remove pages.

- Prepare them for distribution

- If you aim to make the document fillable for others and share it, use the tools on the right to incorporate various fillable fields, signature and date, text box, etc.

Mail your CT extension to the address listed on the extension form. It's crucial to check the CT DRS website for any updates on mailing addresses. This ensures that your extension request is processed without complications.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.