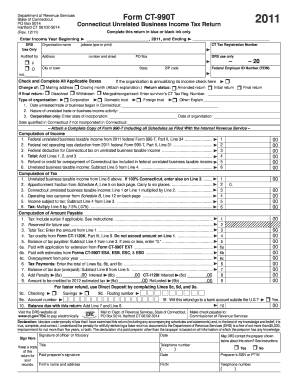

Get Ct Drs Ct-990t 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS CT-990T online

How to fill out and sign CT DRS CT-990T online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax season commenced unexpectedly or you simply overlooked it, it might likely lead to issues for you. CT DRS CT-990T isn't the most straightforward one, but you have no cause for alarm in any case.

Utilizing our expert online software, you will understand how to complete CT DRS CT-990T even in circumstances of severe time shortage. You just need to adhere to these basic instructions:

With this all-encompassing digital solution and its professional tools, filling in CT DRS CT-990T becomes more convenient. Don’t hesitate to try it and have more time for hobbies instead of handling paperwork.

Access the document with our sophisticated PDF editor.

Complete all necessary information in CT DRS CT-990T, using fillable fields.

Insert images, marks, checkboxes, and text boxes, if needed.

Recurrent information will be automatically filled in after the initial entry.

If there are uncertainties, activate the Wizard Tool. You will receive helpful hints for much simpler submissions.

Remember to include the application date.

Generate your distinct signature once and position it in the required spaces.

Verify the information you have entered. Amend any errors if necessary.

Click Done to complete the adjustments and choose how you will send it. You will have the option to use digital fax, USPS, or email.

You can even download the document to print it later or upload it to cloud storage.

How to modify Get CT DRS CT-990T 2011: personalize forms online

Choose a reliable document editing choice you can depend on. Modify, execute, and validate Get CT DRS CT-990T 2011 safely online.

Frequently, altering documents, such as Get CT DRS CT-990T 2011, can be troublesome, especially if you have them in a digital format but lack access to specific software. Naturally, you can discover some alternatives to overcome this, but you may end up with a form that fails to meet the submission criteria. Utilizing a printer and scanner isn’t a viable option either, as it is both time- and resource-intensive.

We present a more straightforward and efficient method of altering forms. A vast array of document templates that are easy to modify and validate, turning them into fillable forms for others. Our solution extends well beyond a mere assortment of templates. One of the greatest advantages of using our service is that you can edit Get CT DRS CT-990T 2011 directly on our platform.

Being an online-based system, it relieves you from the need to acquire any computer software. Moreover, not all corporate policies permit downloading it on your business computer. Here’s the most effective way to effortlessly and securely manage your paperwork with our service.

Bid farewell to paper and other ineffective techniques for completing your Get CT DRS CT-990T 2011 or various forms. Opt for our solution that merges one of the most extensive collections of customizable forms with a powerful document editing tool. It’s uncomplicated and secure, and can save you considerable time! Don't just take our word for it, experience it for yourself!

- Click the Get Form > you’ll be promptly directed to our editor.

- Once opened, you can initiate the editing process.

- Choose checkmark or circle, line, arrow, cross, and other options to annotate your document.

- Select the date field to insert a specific date into your file.

- Incorporate text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to insert fillable {fields.

- Click Sign from the upper toolbar to create and incorporate your legally-binding signature.

- Press DONE and save, print, and share or obtain the output.

Related links form

To get a sales tax certificate in Connecticut, you must complete the application process through the CT Department of Revenue Services. This certificate is necessary for businesses to buy goods without paying sales tax. Referencing the CT DRS CT-990T can assist with any necessary tax filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.