Get Ct Drs Ct-eitc Seq 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-EITC SEQ online

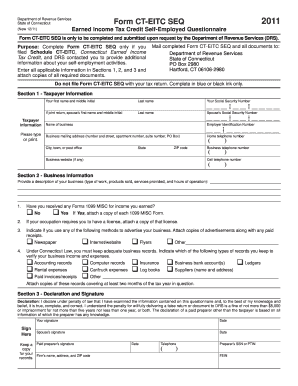

Filling out the CT DRS CT-EITC SEQ, or the Earned Income Tax Credit Self-Employed Questionnaire, is essential for self-employed individuals who have been requested to provide additional information by the Department of Revenue Services. This guide provides a clear and structured approach to completing the form accurately online.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section 1, enter your taxpayer information. This includes your first name, middle initial, last name, Social Security Number, and the name of your business. Ensure to also provide your business mailing address, home telephone number, and if applicable, your spouse's details.

- In Section 2, describe your business, including the type of work you do, products you sell or services you provide, and your hours of operation. Be comprehensive and clear.

- Answer the questions regarding Forms 1099 MISC, licenses, and methods of advertising. Make sure to attach any necessary documents such as copies of 1099 MISC forms and advertisements.

- Indicate which business records you maintain for verifying income and expenses. This could include accounting records, business bank accounts, and receipts.

- In Section 3, read the declaration statement carefully. You must sign and date the form to attest that the information provided is true and complete. If applicable, your spouse must also sign.

- Once all sections are completed, save your changes. You may choose to print the form or share it electronically as required.

Take the next step in your filing process by completing the CT DRS CT-EITC SEQ online today.

Get form

Related links form

To file your EITC, you must complete your federal tax return using Form 1040 or 1040-SR. Then, ensure that you include the relevant information specific to the CT DRS CT-EITC SEQ requirements. Filing online can simplify this process significantly. Platforms like USLegalForms can provide structured guidance to help you maximize your credits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.