Loading

Get Ct Drs Ct-w3 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-W3 online

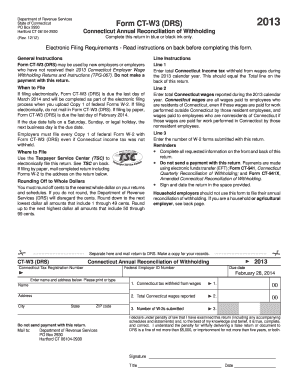

Filling out the CT DRS CT-W3 form is an essential task for employers in Connecticut who need to reconcile withholding tax. This guide will provide you with detailed, step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out your CT DRS CT-W3 form online.

- Press the ‘Get Form’ button to access the CT DRS CT-W3 document and open it in your editing tool.

- Begin by entering your Connecticut tax registration number and federal employer ID number in the designated spaces. Ensure that these numbers are accurate, as they are essential for your submission.

- In Line 1, input the total Connecticut income tax withheld from wages during the specified calendar year. This figure should correspond with the total found on the back of the form.

- For Line 2, enter the total Connecticut wages reported during the same calendar year. Remember that this includes all wages paid to both residents and nonresidents based on where the work was performed.

- In Line 3, provide the number of W-2 forms you are submitting along with this return. You must include every W-2 form even if no Connecticut income tax was withheld.

- Review all the information you have entered to ensure accuracy. It is important to complete all requested information on both sides of the return.

- Sign and date the return in the provided space to confirm that the information is true and complete to the best of your knowledge.

- Save your completed form. You can choose to download, print, or share it for your records. If you are filing electronically, do not mail a paper copy of the CT-W3.

Complete your CT DRS CT-W3 form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain your CT tax forms directly from the CT DRS website, which offers a variety of downloadable forms for different tax purposes. If you prefer a more comprehensive solution, platforms like US Legal Forms provide easy access to all necessary tax forms, including filing instructions that guide you through each step.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.