Get Ct Drs Ct-w4 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Nonresidents online

How to fill out and sign False online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

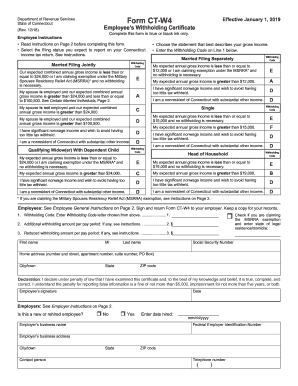

When the tax period began unexpectedly or you just misssed it, it would probably cause problems for you. CT DRS CT-W4 is not the simplest one, but you do not have reason for panic in any case.

Utilizing our powerful solution you will see how you can complete CT DRS CT-W4 in situations of critical time deficit. You just need to follow these easy instructions:

-

Open the record with our advanced PDF editor.

-

Fill in the info needed in CT DRS CT-W4, utilizing fillable fields.

-

Insert pictures, crosses, check and text boxes, if it is supposed.

-

Repeating information will be added automatically after the first input.

-

In case of misunderstandings, turn on the Wizard Tool. You will get some tips for much easier submitting.

-

Never forget to include the date of application.

-

Draw your unique e-signature once and place it in all the required fields.

-

Check the information you have filled in. Correct mistakes if necessary.

-

Click on Done to finish editing and select how you will send it. There is the ability to use virtual fax, USPS or email.

-

Also you can download the file to print it later or upload it to cloud storage.

With our complete digital solution and its helpful tools, filling in CT DRS CT-W4 becomes more practical. Do not wait to try it and have more time on hobbies and interests rather than on preparing documents.

How to modify Underpayment: personalize forms online

Completing paperwork is easy with smart online tools. Get rid of paperwork with easily downloadable Underpayment templates you can modify online and print.

Preparing documents and documents needs to be more accessible, whether it is a day-to-day component of one’s profession or occasional work. When a person must file a Underpayment, studying regulations and tutorials on how to complete a form correctly and what it should include might take a lot of time and effort. Nonetheless, if you find the right Underpayment template, finishing a document will stop being a struggle with a smart editor at hand.

Discover a broader range of functions you can add to your document flow routine. No need to print, fill in, and annotate forms manually. With a smart editing platform, all of the essential document processing functions will always be at hand. If you want to make your work process with Underpayment forms more efficient, find the template in the catalog, click on it, and discover a simpler way to fill it in.

- If you need to add text in a random part of the form or insert a text field, use the Text and Text field tools and expand the text in the form as much as you want.

- Use the Highlight tool to stress the key aspects of the form. If you need to conceal or remove some text parts, use the Blackout or Erase tools.

- Customize the form by adding default graphic components to it. Use the Circle, Check, and Cross tools to add these elements to the forms, if required.

- If you need additional annotations, use the Sticky note tool and put as many notes on the forms page as required.

- If the form needs your initials or date, the editor has tools for that too. Reduce the chance of errors by using the Initials and Date tools.

- It is also easy to add custom visual components to the form. Use the Arrow, Line, and Draw tools to change the file.

The more tools you are familiar with, the simpler it is to work with Underpayment. Try the solution that offers everything necessary to find and modify forms in a single tab of your browser and forget about manual paperwork.

CT payroll taxes include income taxes that are withheld from employee wages as well as other mandatory contributions such as unemployment insurance. Employers must comply with regulations set by the CT DRS CT-W4 to calculate the appropriate amount of state income tax to withhold. Understanding these taxes helps you plan your finances better and ensure you meet your tax obligations. It's essential to stay informed about any changes in tax rates that may affect your payroll obligations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.