Get Ct Drs Ct-w4 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-W4 online

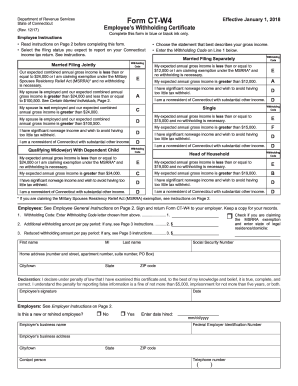

Filling out the CT DRS CT-W4 online is an essential step for ensuring your employer withholds the correct amount of Connecticut income tax from your wages. This guide will provide you with a clear, step-by-step process to navigate through the form effortlessly.

Follow the steps to effectively complete the CT DRS CT-W4 online.

- Press the ‘Get Form’ button to access the CT DRS CT-W4 form in the editor.

- Begin by reading the instructions on Page 2 to familiarize yourself with the requirements for completing the form.

- Select your expected filing status from the provided options, which include Married Filing Jointly, Single, and Head of Household. This will dictate the Withholding Code applicable to your situation.

- For line 1, enter the Withholding Code that corresponds to your expected gross income and filing status. The codes vary, so ensure you choose the correct one.

- If applicable, indicate any additional withholding amount per pay period on line 2. Follow the guidance in Page 3 instructions for amounts.

- If you wish to reduce withholdings, enter the reduced withholding amount on line 3.

- Fill in your personal information, including your first name, middle initial, last name, Social Security number, home address, city, state, and ZIP code.

- Provide your signature on the declaration line, affirming that the information provided is accurate, followed by the date of signing.

- Check the box indicating if you are claiming the Military Spouses Residency Relief Act exemption, if applicable.

- Finally, review your completed form for accuracy, and proceed to save changes, download, print, or share your form as needed.

Complete your CT DRS CT-W4 online today to ensure your tax withholdings are accurate.

Get form

The W4 form is a tax form that employees use to inform their employers how much federal and state income tax to withhold from their paychecks. In Connecticut, the CT DRS CT-W4 is the specific version used for state tax withholding. Completing this form accurately ensures that the right amount of taxes are deducted, helping you avoid underpayment penalties or overpayment. Be sure to update your W4 when life circumstances change.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.